With nearly fifteen years of corporate financial advisory experience, Jonathan Voelkel has worked with hundreds of engineering, architecture, and environmental consulting firms across the U.S. and abroad, in all facets of mergers & acquisitions, valuation, ownership transition planning, equity incentive compensation, and ESOP advisory. Jonathan received his Bachelor of Arts (BA) degree in Economics from Johns Hopkins University.

If your stock is becoming too expensive…

If your stock is becoming too expensive…

April 24, 2014

It’s an increasingly common refrain that we hear. As firms experience growth in revenue and earnings, their stock value naturally increases. This might be great for the existing shareholders, but from the vantage point of ownership transition planning it can be problematic if new investors decide that they can no longer afford to buy in. Some firms choose to address this issue by artificially depressing their share price, or heavily discounting it for new investors. But this can create a host of other problems. A potential solution to this issue is a leveraged recapitalization.

A leveraged recapitalization can provide liquidity to existing owners and/or future growth by borrowing against the company’s future earnings while also allowing the shareholders to maintain their ownership and control of the company. Additionally (and most importantly) a leveraged recapitalization, can temporarily reduce the company’s share price, making it easier for new shareholders to invest in the firm.

In broad terms, there are two types of leveraged recapitalization. The first is known as a leveraged cash-out, in which the company gives its owners a special dividend financed by debt. Because of this dividend’s issuance, the market value of the company’s shares will decrease, thereby allowing new shareholders to buy-in at a lower cost. The second type is known as a leveraged share repurchase, which is where the company repurchases a large block of shares, again, financed by debt. To illustrate the benefits mentioned above, this article focuses on the former of the two types of recapitalization.

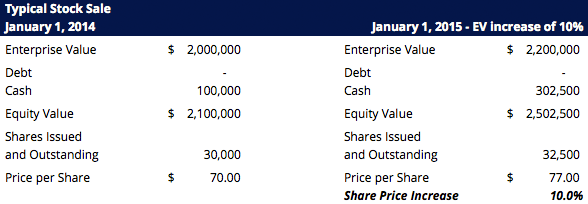

To illustrate this, let’s first look at an example of a typical scenario of a growing firm selling stock to new investors. Let’s assume in Example A that the enterprise value (EV) of your firm was $2.0 million on January 1, 2014, that there were no outstanding debt obligations, and that the firm had $100,000 in cash. This would represent an equity value of $2.1 million. Let’s also assume that there were 30,000 shares issued and outstanding – this would represent a price per share of $70.00. Your firm sells 2,500 shares at $70.00 and collects $175,000 from the sale of these new shares. One year later, the enterprise value of the company and its cash balance (including the cash received from the sale of new shares) have both increased by 10% due to growth in revenue and earnings, so when we calculate the updated equity value, the result is $2,502,500, or $77.00 per share—an increase of 10%, as would be expected.

Example A

A leveraged recapitalization can provide liquidity to existing owners and/or future growth by borrowing against the company’s future earnings while also allowing the shareholders to maintain their ownership and control of the company. Additionally (and most importantly) a leveraged recapitalization, can temporarily reduce the company’s share price, making it easier for new shareholders to invest in the firm.

In broad terms, there are two types of leveraged recapitalization. The first is known as a leveraged cash-out, in which the company gives its owners a special dividend financed by debt. Because of this dividend’s issuance, the market value of the company’s shares will decrease, thereby allowing new shareholders to buy-in at a lower cost. The second type is known as a leveraged share repurchase, which is where the company repurchases a large block of shares, again, financed by debt. To illustrate the benefits mentioned above, this article focuses on the former of the two types of recapitalization.

To illustrate this, let’s first look at an example of a typical scenario of a growing firm selling stock to new investors. Let’s assume in Example A that the enterprise value (EV) of your firm was $2.0 million on January 1, 2014, that there were no outstanding debt obligations, and that the firm had $100,000 in cash. This would represent an equity value of $2.1 million. Let’s also assume that there were 30,000 shares issued and outstanding – this would represent a price per share of $70.00. Your firm sells 2,500 shares at $70.00 and collects $175,000 from the sale of these new shares. One year later, the enterprise value of the company and its cash balance (including the cash received from the sale of new shares) have both increased by 10% due to growth in revenue and earnings, so when we calculate the updated equity value, the result is $2,502,500, or $77.00 per share—an increase of 10%, as would be expected.

Example A

Here is where the affordability issue can surface. If the growth illustrated above continues at the same rate, the Company’s share price would double every seven years (approximately). Unless the pool of new investors is growing at the same rate, this will be problematic for your ownership transition plan.

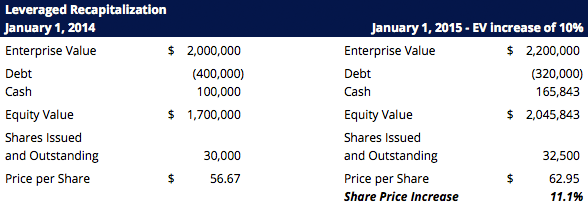

So let’s look at how a leveraged recapitalization might improve this scenario. In Example B, we assume that the company has borrowed $400,000 and used the proceeds to fund a special dividend to the existing shareholders. As in Example A, we have assumed the company decides to sell 2,500 shares – but now, due to the impact of the new debt on the company’s equity value, the price is reduced to $56.67 per share—making the stock much more affordable for new shareholders.

Using the same assumption of 10% growth in enterprise value and cash, including the $141,667 ($56.67 x 2,500) raised from the sale of new shares, and the impact on cash and debt balances from debt service payments, the resulting stock value one year later is $62.95.

Example B

So let’s look at how a leveraged recapitalization might improve this scenario. In Example B, we assume that the company has borrowed $400,000 and used the proceeds to fund a special dividend to the existing shareholders. As in Example A, we have assumed the company decides to sell 2,500 shares – but now, due to the impact of the new debt on the company’s equity value, the price is reduced to $56.67 per share—making the stock much more affordable for new shareholders.

Using the same assumption of 10% growth in enterprise value and cash, including the $141,667 ($56.67 x 2,500) raised from the sale of new shares, and the impact on cash and debt balances from debt service payments, the resulting stock value one year later is $62.95.

Example B

So to summarize, in the leveraged recapitalization scenario above, existing shareholders are paid a special dividend of $400,000, funded by debt. The new debt immediately lowers the per share price for new investors by 19%, making the stock more affordable and a more attractive investment. Assuming 10% growth in revenue and earnings over the next year, the existing shareholders still realize a positive annual return of 9% (the decrease in their stock value being offset by the $400,000 dividend they received), which is only slightly less than in Example A. Finally, the new shareholders see an 11.1% appreciation in their initial investment.

The scenario illustrated above is what makes the argument for a leveraged recapitalization so compelling – current owners are able to enjoy a one-time dividend payment while making the investment more affordable for new shareholders.

Companies that are best-suited for this type of ownership planning are those that have strong and consistent cash flows and are not highly leveraged to begin with. If yours is such a firm, and you feel that there is a chasm between the financial constraints of potential owners and the financial expectations of current owners, a leveraged recapitalization may be worth considering. If you’d like to learn more about this and other strategies for ownership transition, please feel free to contact us.

Rusk O’Brien Gido + Partners provides financial advisory services for the architecture, engineering and environmental consulting industries. We are accredited business appraisers with decades of experience in providing valuations, mergers & acquisition advisory services and ownership transition planning.

The scenario illustrated above is what makes the argument for a leveraged recapitalization so compelling – current owners are able to enjoy a one-time dividend payment while making the investment more affordable for new shareholders.

Companies that are best-suited for this type of ownership planning are those that have strong and consistent cash flows and are not highly leveraged to begin with. If yours is such a firm, and you feel that there is a chasm between the financial constraints of potential owners and the financial expectations of current owners, a leveraged recapitalization may be worth considering. If you’d like to learn more about this and other strategies for ownership transition, please feel free to contact us.

Rusk O’Brien Gido + Partners provides financial advisory services for the architecture, engineering and environmental consulting industries. We are accredited business appraisers with decades of experience in providing valuations, mergers & acquisition advisory services and ownership transition planning.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms