Steve Gido specializes in corporate financial advisory services with a focus on mergers and acquisitions. Steve has assisted architecture, engineering, environmental consulting and construction firms of all sizes across North America achieve their growth or liquidity goals through successful mergers & acquisitions. Steve has over 15 years of investment banking experience and holds the chartered financial analyst (CFA) designation from the CFA Institute.

Is It a Good Time to Sell?

Is It a Good Time to Sell?

December 19, 2012

Over the next few weeks, as we typically see at the end of every year, there will be a flurry of press releases announcing A/E mergers and acquisitions of all shapes and sizes. Some of these transactions will be fairly surprising; others may not be, particularly if you are familiar with the motivations and circumstances behind the deal. Buyers and sellers, along with their teams of attorneys and bankers/advisors, are working overtime to get as many deals closed before the end of the year as possible.

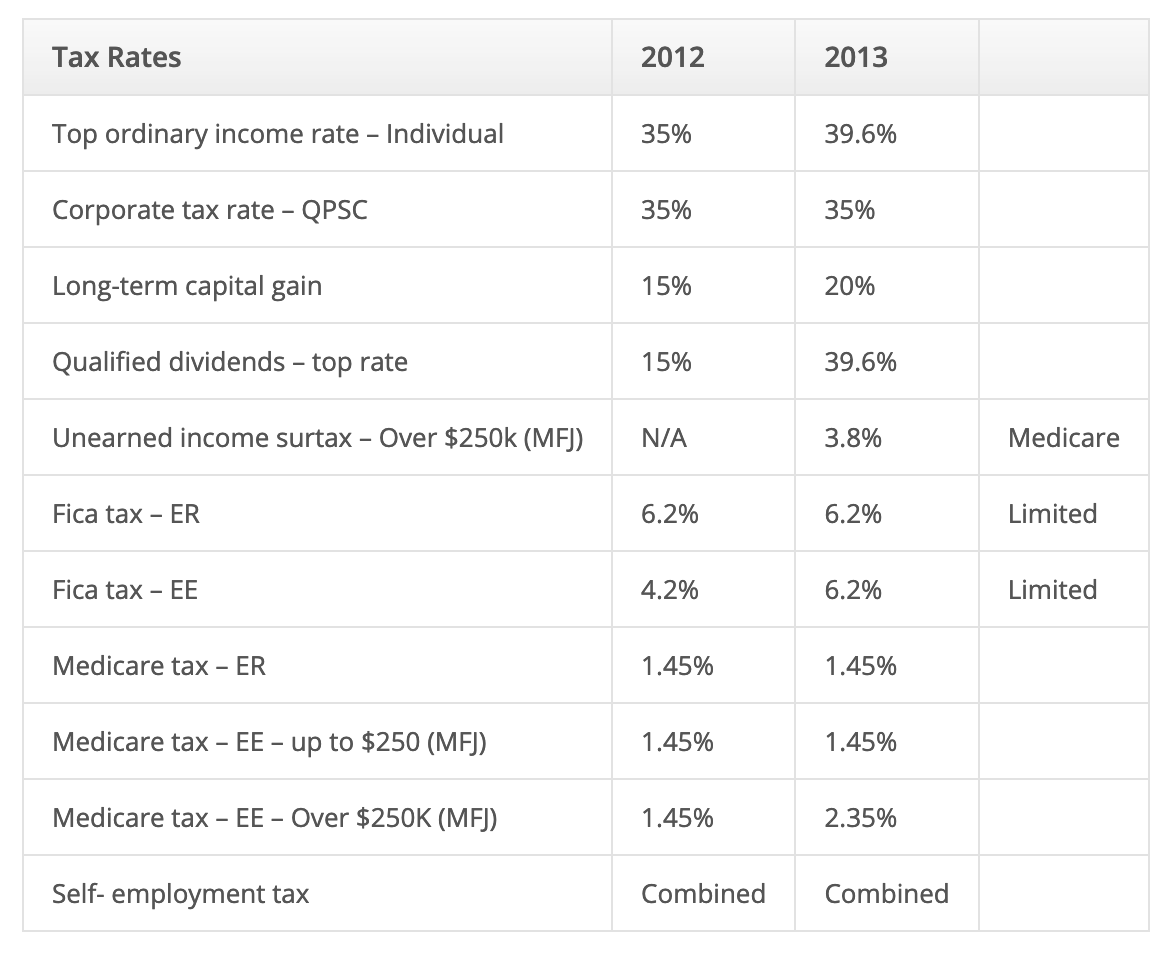

As we saw in 2010, one of the key motivations for sellers this year is tax minimization. Uncertainty remains in Washington on how exactly to solve the dreaded “fiscal cliff,” although there is (dare we utter?) hope that a compromise may in fact be reached soon. However, the fundamental reality is that tax rates, across many forms, could be on the rise. The table below, provided by David Sullivan, an A/E accounting and tax Partner at DiCicco, Gulman and Company, showcases some of the possible scenarios individuals and small business owners may be facing in 2013:

As we saw in 2010, one of the key motivations for sellers this year is tax minimization. Uncertainty remains in Washington on how exactly to solve the dreaded “fiscal cliff,” although there is (dare we utter?) hope that a compromise may in fact be reached soon. However, the fundamental reality is that tax rates, across many forms, could be on the rise. The table below, provided by David Sullivan, an A/E accounting and tax Partner at DiCicco, Gulman and Company, showcases some of the possible scenarios individuals and small business owners may be facing in 2013:

Source: DiCicco, Gulman and Company

As you might expect given this scenario, a frequent question from A/E owners and executives is “So when is the right time to sell?” Naturally, after a pace of frenetic “event-driven” deal-making, there will likely be a slight pause in 2013 and some individuals who didn’t consummate a transaction will ask themselves if they missed a good opportunity to “take some chips off the table.” That question touches on many complex organizational and personal goals that we thought we would objectively address from two lenses.

The case for pursuing a firm sale now

As we have discussed in prior Perspectives, selling and joining forces with another firm is driven by many factors. For larger A/E firms ($15MM+ in revenue) those issues might be driven by organizational limitations, lack of scale, capitalization deficiencies, and intense competition. Smaller firms are often impacted by similar forces, but typically also have pressing sole owner or partner ownership transition challenges, lack of management depth, and health/age related issues.

The case for selling in the short-term is fairly straightforward; many don’t expect the economy and A/E industry to be materially better (in fact, things could get worse) in the next few years; today’s competitive environment remains unforgiving; the tax and regulatory environment is increasingly unfavorable; and as scores of baby boomer owners prepare to retire, personal net worth diversification through monetization of their ownership stakes will be a larger personal and firm objective.

Complimenting those factors is that while industry valuations are not at pre-recession levels, they are certainly back to historic, normal levels. In fact, some strategic buyers are paying higher multiples for firms in resilient and growing sectors such as power/energy, environmental, infrastructure, and manufacturing. In addition, private equity firms are increasingly active and interested in our space, seeking new “platform” acquisition opportunities as well as making add-on purchases to their existing A/E investments.

Finally, with organic growth prospects limited, many buyers are aggressively ramping up their M&A search efforts for 2013 and are interested in talking to motivated participants. Today’s buyers, unlike 2009, have excess cash sitting on their books (earning practically nothing!) that they want to put toward higher yielding pursuits, such as synergistic and accretive acquisitions. In addition, the cost of debt capital/acquisition financing remains at record lows, adding more fuel to the fire.

The case for holding off

The fact of the matter is that there are thousands of A/E management teams that are perfectly happy with their current independent path and market position. Many either have a formal ownership transition plan in place or would much prefer to go that route than selling to a larger entity with an unfamiliar culture, management compatibility, and design philosophy. While escalating taxes is an unfortunate predicament, other professional and personal priorities are more paramount.

And many owners that would like to sell someday also recognize that their firm’s last 3 or 4 years of financial results have been lackluster. When multi-year growth rates have been flat (or down!), consistent profits have been elusive, backlog is not where it needs to be, and balance sheets are upside down, oftentimes that is not an ideal time to engage with a buyer or test the waters. This economy has produced a number of profiles on small business and A/E and construction owners who would like to sell, but don’t want to settle for lowball offers and are simply resigned to keep working while delaying retirement.

Other A/E executives, particularly those who have seen the natural cycles of the design and construction market for decades, aren’t as gloomy on the economic outlook. They realize excesses have to be worked off, debts paid, and “animal spirits” need to return. They know their organizations will grow alongside that rising industry tide again. Their argument for holding pat is that better bottom line performance and higher valuations down the road will easily compensate the opportunity cost of lower capital gains rates missed today. As Kenny Rogers also wisely concluded in his song, “There’ll be time enough for countin’ when the dealin’s done.”

At ROG+ Partners, we possess strong relationships and years of experience navigating A/E and environmental buyers and sellers through the M&A process and towards winning combinations. Whether you are seeking to grow through acquisitions or by evaluating your firm’s strategic and ownership alternatives, please contact us as to how we can help your organization.

On a final note, Season’s Greetings and a Happy and Prosperous New Year from all of us here at ROG!

As you might expect given this scenario, a frequent question from A/E owners and executives is “So when is the right time to sell?” Naturally, after a pace of frenetic “event-driven” deal-making, there will likely be a slight pause in 2013 and some individuals who didn’t consummate a transaction will ask themselves if they missed a good opportunity to “take some chips off the table.” That question touches on many complex organizational and personal goals that we thought we would objectively address from two lenses.

The case for pursuing a firm sale now

As we have discussed in prior Perspectives, selling and joining forces with another firm is driven by many factors. For larger A/E firms ($15MM+ in revenue) those issues might be driven by organizational limitations, lack of scale, capitalization deficiencies, and intense competition. Smaller firms are often impacted by similar forces, but typically also have pressing sole owner or partner ownership transition challenges, lack of management depth, and health/age related issues.

The case for selling in the short-term is fairly straightforward; many don’t expect the economy and A/E industry to be materially better (in fact, things could get worse) in the next few years; today’s competitive environment remains unforgiving; the tax and regulatory environment is increasingly unfavorable; and as scores of baby boomer owners prepare to retire, personal net worth diversification through monetization of their ownership stakes will be a larger personal and firm objective.

Complimenting those factors is that while industry valuations are not at pre-recession levels, they are certainly back to historic, normal levels. In fact, some strategic buyers are paying higher multiples for firms in resilient and growing sectors such as power/energy, environmental, infrastructure, and manufacturing. In addition, private equity firms are increasingly active and interested in our space, seeking new “platform” acquisition opportunities as well as making add-on purchases to their existing A/E investments.

Finally, with organic growth prospects limited, many buyers are aggressively ramping up their M&A search efforts for 2013 and are interested in talking to motivated participants. Today’s buyers, unlike 2009, have excess cash sitting on their books (earning practically nothing!) that they want to put toward higher yielding pursuits, such as synergistic and accretive acquisitions. In addition, the cost of debt capital/acquisition financing remains at record lows, adding more fuel to the fire.

The case for holding off

The fact of the matter is that there are thousands of A/E management teams that are perfectly happy with their current independent path and market position. Many either have a formal ownership transition plan in place or would much prefer to go that route than selling to a larger entity with an unfamiliar culture, management compatibility, and design philosophy. While escalating taxes is an unfortunate predicament, other professional and personal priorities are more paramount.

And many owners that would like to sell someday also recognize that their firm’s last 3 or 4 years of financial results have been lackluster. When multi-year growth rates have been flat (or down!), consistent profits have been elusive, backlog is not where it needs to be, and balance sheets are upside down, oftentimes that is not an ideal time to engage with a buyer or test the waters. This economy has produced a number of profiles on small business and A/E and construction owners who would like to sell, but don’t want to settle for lowball offers and are simply resigned to keep working while delaying retirement.

Other A/E executives, particularly those who have seen the natural cycles of the design and construction market for decades, aren’t as gloomy on the economic outlook. They realize excesses have to be worked off, debts paid, and “animal spirits” need to return. They know their organizations will grow alongside that rising industry tide again. Their argument for holding pat is that better bottom line performance and higher valuations down the road will easily compensate the opportunity cost of lower capital gains rates missed today. As Kenny Rogers also wisely concluded in his song, “There’ll be time enough for countin’ when the dealin’s done.”

At ROG+ Partners, we possess strong relationships and years of experience navigating A/E and environmental buyers and sellers through the M&A process and towards winning combinations. Whether you are seeking to grow through acquisitions or by evaluating your firm’s strategic and ownership alternatives, please contact us as to how we can help your organization.

On a final note, Season’s Greetings and a Happy and Prosperous New Year from all of us here at ROG!

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms