Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

Ownership Planning – The Single Most Important Factor in Ensuring Long-term Business Success

Ownership Planning – The Single Most Important Factor in Ensuring Long-term Business Success

October 6, 2010

The architecture, engineering and environmental consulting professions are “people” businesses. There’s no getting around it. Long-term business success is built upon attracting and retaining the right kind of people—people with technical skills, project management skills, people management skills, marketing and business development skills and perhaps most importantly, the ability develop a strong rapport with clients. Firms that cannot attract and retain such key employees will at best find themselves on a perpetual treadmill, working hard but never actually moving forward (and likely to move backward if they miss a step).

While there are many aspects of a firm’s workplace that make it an attractive home for key employees, nothing is more critical than the opportunity to become an owner. The people you need to build and sustain your business are not the sort that will be satisfied with being a wage earner and order taker. You need people that want to be owners, people that are willing to invest their own savings in the company and aspire to real leadership roles. And if you’re lucky enough to have attracted such people to your firm already, you better start making the promise of ownership a reality if you want them to stay.

Trust me. I’ve had first hand experience with owners that hoard all the equity for themselves (often out of insecurity and a fear of having “partners” to whom they might actually have to be accountable themselves). These owners often try to retain their key people with various incentive compensation plans or worse, chain them to the firm with non-compete agreements. These approaches more often than not fail in attracting and keeping A-level talent. Instead these “keep all the equity for myself” owners end up surrounded by sycophants—“yes-men” and women without an entrepreneurial bone in their bodies. This is not a recipe for long-term success.

Ownership as a Retention Tool

On the other hand, the most successful firms I’ve had the pleasure of working with have had widely distributed ownership, often with a ratio of owners to total staff of 1:10 or higher. Furthermore, these firms have structured their ownership plans to closely correlate the level of an individual’s ownership with their level of leadership within the firm.

To be clear, when I’m talking about ownership, I’m talking about direct share ownership, not ownership through an ESOP, or so-called synthetic equity (phantom stock or stock appreciation rights). These tools have their place, but they are not a substitute for direct share ownership when it comes to attracting and retaining top-level talent. Creating such instruments or even alternate classes of stock (e.g. non-voting shares) without good reason for doing so can reduce the effectiveness of your ownership plan as a retention tool.

“Simplify, Simplify”

I prefer that quote from Henry David Thoreau over the crasser version—“keep it simple, stupid,” but either will do as a philosophy when it comes to ownership planning. Just as I eschew complex synthetic stock instruments, I have a strong preference for simple, easy to understand ownership plans. Simplicity and transparency should flow through all elements of your ownership plan and philosophy, from corporate documents and shareholder agreements, to the way you value your stock and the information you share with employees. Don’t forget that you are typically dealing with financially unsophisticated investors. A plan that is easy to understand will inspire confidence. One that is overly complex will arouse suspicion.

For example, a nice, simple shareholders agreement will cover the events that should trigger the redemption of an owner’s shares (retirement, termination of employment, death, disability, etc.). It should detail the terms of repurchase (how much with cash, how much with a note payable, the rate and term of the note, etc.). It should also specify how the stock will be valued. A twenty page agreement is probably sufficient. A two hundred page agreement will send potential owners running for the exits.

A different take on non-competes

Here’s where you can employ an approach to discouraging competition. Rather than having non-compete language in your shareholders agreement or a separate non-compete agreement, you might instead include a provision in your shareholders agreement that states that a shareholder who leaves before retirement and chooses to compete directly will suffer a penalty of some sort when their shares are redeemed. That penalty could take the form of a reduced valuation, extended repurchase terms, or both.

I like this approach much more than the traditional non-compete agreement. To begin with, it does not unfairly restrict the individual from earning a living. It simply requires them to leave money on the table if they do. Also, it does not require the same effort and legal expense to enforce as a non-compete agreement does. In a way, it’s self-enforcing. And let’s face it, do you really want employees in your organization that are unhappy and want to leave, but are staying only because they are bound by a non-compete agreement? Of course not.

“Plans are nothing, but planning is everything.”

This Eisenhower quote rings true when it comes to ownership planning. The process of planning requires you to think about your organization, its potential for growth and its future financial performance, the people you employ, and the personal objectives and retirement horizons of all parties. The exercise is a very valuable one, but the road map you create will have a short shelf-life. Your ownership plan will need to be re-visited periodically and course corrections will have to be made.

The process we employ involves interviewing all parties (current employee-owners and prospective employee-owners) to understand their personal objectives and their feelings about investing in their employer’s stock. We’ll conduct a thorough analysis of the company and its financial performance to better understand the value of the stock, and the ability of the company and its cash flow to support future stock transactions (i.e., the redemptions of shares from exiting shareholders and the financing of stock purchases by aspiring shareholders). All these factors are assembled into a 10-year (or longer) projection of the firm’s financial performance, the resulting change in stock value, the stock transaction activity over the forecast period, and the impact of the related financing.

Why now?

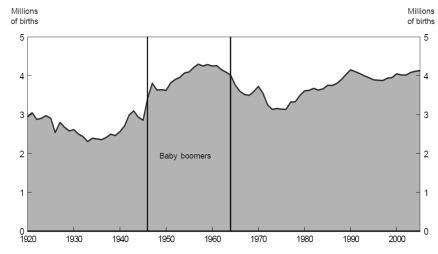

This sort of ownership planning exercise has never been more important than it is today. The simple age demographics of the US indicate that over the next five years there will be a significant turnover in ownership as baby-boomers retire. Complicating this is the fact the generation immediately following the “boomers” is much smaller. This puts more stress on ownership transition. Forecasting and planning is the key to managing major redemption liabilities.

While there are many aspects of a firm’s workplace that make it an attractive home for key employees, nothing is more critical than the opportunity to become an owner. The people you need to build and sustain your business are not the sort that will be satisfied with being a wage earner and order taker. You need people that want to be owners, people that are willing to invest their own savings in the company and aspire to real leadership roles. And if you’re lucky enough to have attracted such people to your firm already, you better start making the promise of ownership a reality if you want them to stay.

Trust me. I’ve had first hand experience with owners that hoard all the equity for themselves (often out of insecurity and a fear of having “partners” to whom they might actually have to be accountable themselves). These owners often try to retain their key people with various incentive compensation plans or worse, chain them to the firm with non-compete agreements. These approaches more often than not fail in attracting and keeping A-level talent. Instead these “keep all the equity for myself” owners end up surrounded by sycophants—“yes-men” and women without an entrepreneurial bone in their bodies. This is not a recipe for long-term success.

Ownership as a Retention Tool

On the other hand, the most successful firms I’ve had the pleasure of working with have had widely distributed ownership, often with a ratio of owners to total staff of 1:10 or higher. Furthermore, these firms have structured their ownership plans to closely correlate the level of an individual’s ownership with their level of leadership within the firm.

To be clear, when I’m talking about ownership, I’m talking about direct share ownership, not ownership through an ESOP, or so-called synthetic equity (phantom stock or stock appreciation rights). These tools have their place, but they are not a substitute for direct share ownership when it comes to attracting and retaining top-level talent. Creating such instruments or even alternate classes of stock (e.g. non-voting shares) without good reason for doing so can reduce the effectiveness of your ownership plan as a retention tool.

“Simplify, Simplify”

I prefer that quote from Henry David Thoreau over the crasser version—“keep it simple, stupid,” but either will do as a philosophy when it comes to ownership planning. Just as I eschew complex synthetic stock instruments, I have a strong preference for simple, easy to understand ownership plans. Simplicity and transparency should flow through all elements of your ownership plan and philosophy, from corporate documents and shareholder agreements, to the way you value your stock and the information you share with employees. Don’t forget that you are typically dealing with financially unsophisticated investors. A plan that is easy to understand will inspire confidence. One that is overly complex will arouse suspicion.

For example, a nice, simple shareholders agreement will cover the events that should trigger the redemption of an owner’s shares (retirement, termination of employment, death, disability, etc.). It should detail the terms of repurchase (how much with cash, how much with a note payable, the rate and term of the note, etc.). It should also specify how the stock will be valued. A twenty page agreement is probably sufficient. A two hundred page agreement will send potential owners running for the exits.

A different take on non-competes

Here’s where you can employ an approach to discouraging competition. Rather than having non-compete language in your shareholders agreement or a separate non-compete agreement, you might instead include a provision in your shareholders agreement that states that a shareholder who leaves before retirement and chooses to compete directly will suffer a penalty of some sort when their shares are redeemed. That penalty could take the form of a reduced valuation, extended repurchase terms, or both.

I like this approach much more than the traditional non-compete agreement. To begin with, it does not unfairly restrict the individual from earning a living. It simply requires them to leave money on the table if they do. Also, it does not require the same effort and legal expense to enforce as a non-compete agreement does. In a way, it’s self-enforcing. And let’s face it, do you really want employees in your organization that are unhappy and want to leave, but are staying only because they are bound by a non-compete agreement? Of course not.

“Plans are nothing, but planning is everything.”

This Eisenhower quote rings true when it comes to ownership planning. The process of planning requires you to think about your organization, its potential for growth and its future financial performance, the people you employ, and the personal objectives and retirement horizons of all parties. The exercise is a very valuable one, but the road map you create will have a short shelf-life. Your ownership plan will need to be re-visited periodically and course corrections will have to be made.

The process we employ involves interviewing all parties (current employee-owners and prospective employee-owners) to understand their personal objectives and their feelings about investing in their employer’s stock. We’ll conduct a thorough analysis of the company and its financial performance to better understand the value of the stock, and the ability of the company and its cash flow to support future stock transactions (i.e., the redemptions of shares from exiting shareholders and the financing of stock purchases by aspiring shareholders). All these factors are assembled into a 10-year (or longer) projection of the firm’s financial performance, the resulting change in stock value, the stock transaction activity over the forecast period, and the impact of the related financing.

Why now?

This sort of ownership planning exercise has never been more important than it is today. The simple age demographics of the US indicate that over the next five years there will be a significant turnover in ownership as baby-boomers retire. Complicating this is the fact the generation immediately following the “boomers” is much smaller. This puts more stress on ownership transition. Forecasting and planning is the key to managing major redemption liabilities.

Source: National Center for Health Statistics, Centers for Disease Control and Prevention

The consequences of NOT planning

Firms that fail to plan adequately for ownership transition will face some tough decisions. Owners of such firms will likely have difficulty attracting and retaining the next tier of leaders and owners. As a result, they will see an erosion of their equity value due to the limited internal market for their shares. They may be forced to sell externally (i.e., to another firm), but without a strong second tier of leaders, finding a strategic buyer could also prove challenging.

Ultimately I predict that the architecture, engineering and environmental consulting industry will see a significant number of firms simply close up shop over the next decade. But your firm doesn’t have to be one of them. We’ve helped hundreds of firms in the industry develop ownership plans that will sustain them through this demographic shift and ensure their long-term success. We’d be happy to discuss how we can help your firm do the same.

The consequences of NOT planning

Firms that fail to plan adequately for ownership transition will face some tough decisions. Owners of such firms will likely have difficulty attracting and retaining the next tier of leaders and owners. As a result, they will see an erosion of their equity value due to the limited internal market for their shares. They may be forced to sell externally (i.e., to another firm), but without a strong second tier of leaders, finding a strategic buyer could also prove challenging.

Ultimately I predict that the architecture, engineering and environmental consulting industry will see a significant number of firms simply close up shop over the next decade. But your firm doesn’t have to be one of them. We’ve helped hundreds of firms in the industry develop ownership plans that will sustain them through this demographic shift and ensure their long-term success. We’d be happy to discuss how we can help your firm do the same.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms