Michael S. O'Brien is a principal in the Washington, DC office of Rusk O'Brien Gido + Partners. He specializes in corporate financial advisory services including business valuation, fairness and solvency opinions, mergers and acquisitions, internal ownership transition consulting, ESOPs, and strategic planning. Michael has consulted hundreds of architecture, engineering, environmental and construction companies across the U.S. and abroad.

Wall Street Sentiments Suggest Strong A/E Industry Outlook

Wall Street Sentiments Suggest Strong A/E Industry Outlook

February 21, 2017

Sometimes the movement of money in capital markets can tell us a lot about investors’ expectations for a particular stock or a particular industry. In the case of the A/E industry, there are a number of factors that are likely impacting investors’ sentiments. Will increasing rates from the Federal Reserve offset any decrease in tax rates? Will reducing regulations have a positive impact on corporate growth? Will Trump’s trade policies help or hurt U.S. based companies? Based on market’s performance so far, it seems that investors’ sentiments are favorable.

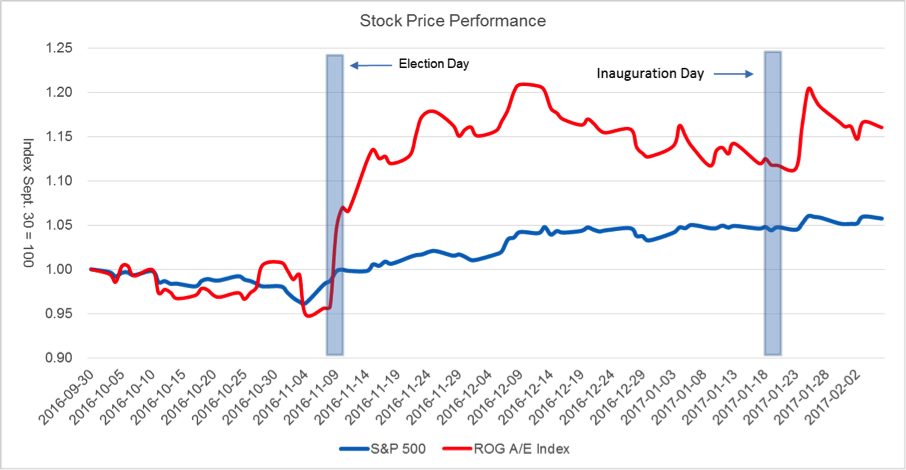

The chart below shows the trend in stock prices in the A/E industry compared to the S&P 500. From September 30, 2016 into the first week in February. The A/E Index (“A/E” – in red) and the S&P 500 Index (“S&P” – in blue), both saw declines of nearly 5% through Election Day. But on November 9th, the day after Trump was elected, the S&P increased 1% and the A/E increased 9%. The increase in the A/E sector stock index shortly after the election implies that investors felt that a Trump victory and Republican control of both houses of Congress would be good for the industry.

Through February 6th, the S&P 500 increased 6% and the A/E Index increase reached as high as 20%. The A/E index has since decreased to about 16% (as of February 6, 2017), but has still out-paced the overall broad market.

The chart below shows the trend in stock prices in the A/E industry compared to the S&P 500. From September 30, 2016 into the first week in February. The A/E Index (“A/E” – in red) and the S&P 500 Index (“S&P” – in blue), both saw declines of nearly 5% through Election Day. But on November 9th, the day after Trump was elected, the S&P increased 1% and the A/E increased 9%. The increase in the A/E sector stock index shortly after the election implies that investors felt that a Trump victory and Republican control of both houses of Congress would be good for the industry.

Through February 6th, the S&P 500 increased 6% and the A/E Index increase reached as high as 20%. The A/E index has since decreased to about 16% (as of February 6, 2017), but has still out-paced the overall broad market.

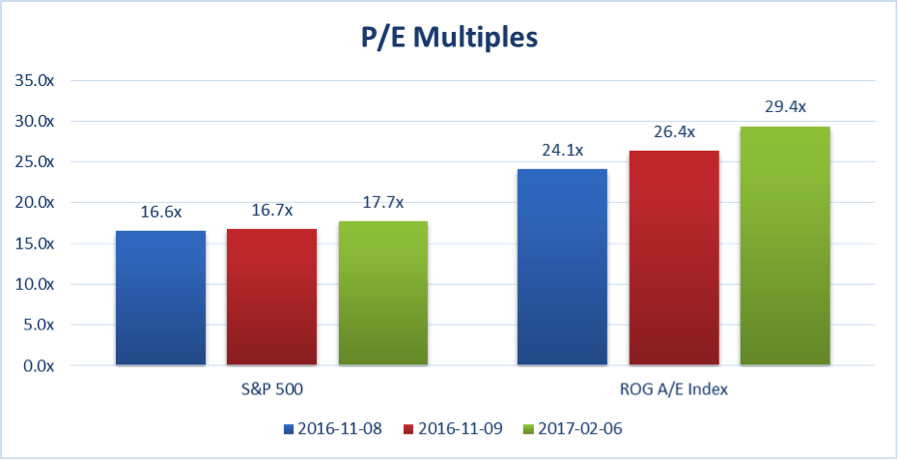

What does this mean to firms operating in the A/E industry? See Chart 2. Stock prices don’t always tell the whole story, but since the election, the S&P 500’s P/E (price/earnings) multiple increased from 16.6x on November 8th to 17.7x on February 6th – an increase of 6.6%. In contrast, the A/E firms’ P/E multiples increased from 24.1x to 29.4x over that same period – an increase of 21.9%. Again, this suggests that the markets are reacting very favorably to the new administration’s proposed agenda.

There are three critical elements of a P/E Multiple: (i) Earnings Per Share (EPS), (ii) projected EPS growth rates, (iii) and the risk of future EPS (the discount rate or required rate of return). Understanding the risks of your investment requires an understanding of the risk to your current earnings stream and its future growth expectations.

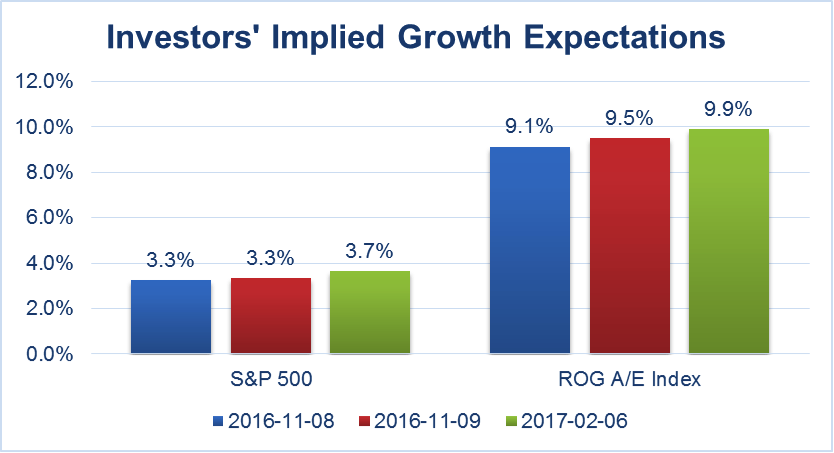

When we analyze investors’ growth expectations for the broad stock market and the A/E industry specifically, the S&P 500 enjoyed the biggest percentage increase in earnings growth potential of 21% (an increase from 3.3% to 3.7%), while the A/E industry growth expectation only changed 8.8% (an increase from 9.1% to 9.9%). This is a very important factor in your risk to future earnings. Had the A/E industry change been much faster than the overall broad market, the perceived risk associated with A/E industry returns would be much greater. Instead, we are seeing a slight decrease in the A/E industry’s perceived risk, and this decrease is the first we have observed since before the recession.

Why does this matter?

When we first started following firms in the A/E industry, the risk profile of A/E firms was generally lower than the risk profile of the overall broad market. Around the time of the last recession, this risk shifted to be much greater than the broad market. Today, while A/E firms perceived risk is still higher than the broad market, it is decreasing. If the A/E industry risk continues to decrease, the impact on values will be positive, and the investment opportunity in this sector could benefit enormously.

Of course, when it comes to the overall outlook for the U.S. economy, there are still many uncertainties, and public markets have been known for their “irrational exuberance.” Only time will tell if the trends highlighted above will continue, but so far, the outlook for the A/E industry in the U.S. seems positive.

Why does this matter?

When we first started following firms in the A/E industry, the risk profile of A/E firms was generally lower than the risk profile of the overall broad market. Around the time of the last recession, this risk shifted to be much greater than the broad market. Today, while A/E firms perceived risk is still higher than the broad market, it is decreasing. If the A/E industry risk continues to decrease, the impact on values will be positive, and the investment opportunity in this sector could benefit enormously.

Of course, when it comes to the overall outlook for the U.S. economy, there are still many uncertainties, and public markets have been known for their “irrational exuberance.” Only time will tell if the trends highlighted above will continue, but so far, the outlook for the A/E industry in the U.S. seems positive.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms