Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

A/E Firm Valuation FAQs Answered

A/E Firm Valuation FAQs Answered

December 4, 2014

Putting a monetary value on an architecture, engineering or environmental consulting firm can be a tricky business. And yet, as business owners and managers, many situations arise that require us to do just that. Whether it’s establishing your own firm’s value for ownership transition purposes, or valuing a firm you are considering acquiring, at some point money will be changing hands and the question of what the firm is worth must be answered. Below are some frequently asked questions (FAQs) regarding the valuation of A/E firms – and our answers.

What is the difference between book value and fair market value?

Book value, sometimes referred to as shareholders equity, is an accounting term. It refers to that section of the balance sheet that reflects the sum of the capital invested in the company by its shareholders and earnings retained and reinvested in the company over time. It should be equal to the total assets of the company, less its liabilities. Don’t confuse book value with the fair market value of a business. The fair market value can be higher or lower (usually it’s higher). This is because the real value of a business enterprise is not the net value of all the “stuff” it owns, but its ability to generate earnings (or more precisely, cash flow), which it in turn can pay out to its shareholders. The present value of this cash flow stream is often higher (particularly in growing firms with strong profit margins) than the net value of the firm’s assets.

What is goodwill?

In the finance and accounting world, goodwill has a very specific definition. It is defined as the difference between a firm’s fair market value, and its book value (assuming the former is higher than the latter). You typically will not see goodwill on a firm’s balance sheet unless it has made an acquisition of another firm. In that case the buyer would record the difference between what it paid for the firm and the net value of the firm’s assets on its balance sheet as goodwill.

Goodwill is an “intangible” asset. You can think of it as representing the value of all the things beyond tangible assets (computers, software, furniture, accounts receivable, etc) that contribute to a firm’s ability to generate cash flow. Those things include the firm’s workforce, their experience and expertise, the firm’s reputation, its client lists and relationships, etc.

How do you value goodwill?

The simple answer to this question is, “you don’t.” That is, rather than trying to place a value on a firm’s workforce, reputation, client lists, etc., an appraiser will determine the fair market value of the business as a whole (inclusive of all its assets, both tangible and intangible). Since all the components of goodwill, together with the firm’s tangible assets contribute to its fair market value, the goodwill is already “baked in” to the firm’s fair market value. Simply deduct the book value of the company from its fair market value, and the result is the value of its goodwill. Allocating that goodwill value between its various components is another challenge altogether—one we won’t tackle here.

What are valuation multiples?

Valuation multiples are used by appraisers in market-based approaches to valuation. Market-based approaches to valuation attempt to establish a firm’s fair market value by looking at transactions of similar firms. These can be transactions of shares of publicly traded companies, or mergers and acquisitions of whole companies (publicly traded or privately held). This approach is analogous to the comparable sales approach used by real estate appraisers. To apply data from these transactions, the appraiser develops ratios of the price paid for the comparable company, and various aspects of the company (such as its revenue, earnings, book value, etc). Since no two firms are exactly alike, the appraiser will usually develop valuation multiples using a group of comparable firms, rather than a single one.

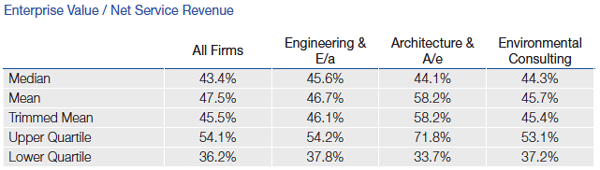

Below is a sample of valuation multiples from our own 2014 A/E Business Valuation and M&A Transactions Study. The 2014 study includes data from over 200 transactions of stock in the A/E and environmental consulting industries. These include internal ownership transition sales, ESOP transactions, and mergers & acquisitions. The study also examines pricing data from publicly traded firms. Valuation multiples are presented for a variety of firm types, and distinguished between minority interest transactions, controlling interest transactions, and ESOP transactions. It also examines how M&A transactions are structured.

What is the difference between book value and fair market value?

Book value, sometimes referred to as shareholders equity, is an accounting term. It refers to that section of the balance sheet that reflects the sum of the capital invested in the company by its shareholders and earnings retained and reinvested in the company over time. It should be equal to the total assets of the company, less its liabilities. Don’t confuse book value with the fair market value of a business. The fair market value can be higher or lower (usually it’s higher). This is because the real value of a business enterprise is not the net value of all the “stuff” it owns, but its ability to generate earnings (or more precisely, cash flow), which it in turn can pay out to its shareholders. The present value of this cash flow stream is often higher (particularly in growing firms with strong profit margins) than the net value of the firm’s assets.

What is goodwill?

In the finance and accounting world, goodwill has a very specific definition. It is defined as the difference between a firm’s fair market value, and its book value (assuming the former is higher than the latter). You typically will not see goodwill on a firm’s balance sheet unless it has made an acquisition of another firm. In that case the buyer would record the difference between what it paid for the firm and the net value of the firm’s assets on its balance sheet as goodwill.

Goodwill is an “intangible” asset. You can think of it as representing the value of all the things beyond tangible assets (computers, software, furniture, accounts receivable, etc) that contribute to a firm’s ability to generate cash flow. Those things include the firm’s workforce, their experience and expertise, the firm’s reputation, its client lists and relationships, etc.

How do you value goodwill?

The simple answer to this question is, “you don’t.” That is, rather than trying to place a value on a firm’s workforce, reputation, client lists, etc., an appraiser will determine the fair market value of the business as a whole (inclusive of all its assets, both tangible and intangible). Since all the components of goodwill, together with the firm’s tangible assets contribute to its fair market value, the goodwill is already “baked in” to the firm’s fair market value. Simply deduct the book value of the company from its fair market value, and the result is the value of its goodwill. Allocating that goodwill value between its various components is another challenge altogether—one we won’t tackle here.

What are valuation multiples?

Valuation multiples are used by appraisers in market-based approaches to valuation. Market-based approaches to valuation attempt to establish a firm’s fair market value by looking at transactions of similar firms. These can be transactions of shares of publicly traded companies, or mergers and acquisitions of whole companies (publicly traded or privately held). This approach is analogous to the comparable sales approach used by real estate appraisers. To apply data from these transactions, the appraiser develops ratios of the price paid for the comparable company, and various aspects of the company (such as its revenue, earnings, book value, etc). Since no two firms are exactly alike, the appraiser will usually develop valuation multiples using a group of comparable firms, rather than a single one.

Below is a sample of valuation multiples from our own 2014 A/E Business Valuation and M&A Transactions Study. The 2014 study includes data from over 200 transactions of stock in the A/E and environmental consulting industries. These include internal ownership transition sales, ESOP transactions, and mergers & acquisitions. The study also examines pricing data from publicly traded firms. Valuation multiples are presented for a variety of firm types, and distinguished between minority interest transactions, controlling interest transactions, and ESOP transactions. It also examines how M&A transactions are structured.

Source: 2014 A/E Business Valuation and M&A Transactions Study (www.rog-partners.com/aestudy)

Why do appraisers use marketability and minority interest discounts?

A lot of confusion could be avoided if the appraisal community simply substituted the word “adjustment” for “discount.” The term discount suggests there is a “full” price, the appraiser is arbitrarily reducing. In fact, adjustments are necessary to present an estimate of value on the appropriate basis (e.g. minority interest or controlling interest) when using market pricing data from a variety of sources. For example, using valuation multiples derived from mergers & acquisitions of whole companies, if left unadjusted, will produce a valuation that also reflects a controlling interest. Therefore, if the goal is to determine the value of a minority interest (e.g. a 3% ownership stake), the appraiser must apply a minority interest discount. Similarly, when valuing a privately held company, if an appraiser uses data from publicly traded firms, the results must be adjusted to reflect the much lower level of liquidity of privately held stock. To quantify these adjustments, appraisers look to a variety of studies conducted by practitioners and academics. As an example, a number of studies have been conducted to quantify the value of marketability/liquidity using data from initial public offerings (IPOs) and restricted stock.

Where can I get reliable valuation data for firms in the A/E and environmental consulting industries?

OK, I admit that this question is a self-served softball. But if you are looking for a source of reliable business valuation data compiled, analyzed and interpreted by accredited business appraisers with decades of experience within the A/E industry, we invite you to check out the aforementioned A/E Business Valuation and M&A Transactions Study. Better yet, if you participate in the confidential on-line survey, you’ll receive a $200 discount on the 2015 edition of this publication (to be released in January of 2015). To participate in the survey, simply follow this link www.rog-partners.com/aestudy.

Why do appraisers use marketability and minority interest discounts?

A lot of confusion could be avoided if the appraisal community simply substituted the word “adjustment” for “discount.” The term discount suggests there is a “full” price, the appraiser is arbitrarily reducing. In fact, adjustments are necessary to present an estimate of value on the appropriate basis (e.g. minority interest or controlling interest) when using market pricing data from a variety of sources. For example, using valuation multiples derived from mergers & acquisitions of whole companies, if left unadjusted, will produce a valuation that also reflects a controlling interest. Therefore, if the goal is to determine the value of a minority interest (e.g. a 3% ownership stake), the appraiser must apply a minority interest discount. Similarly, when valuing a privately held company, if an appraiser uses data from publicly traded firms, the results must be adjusted to reflect the much lower level of liquidity of privately held stock. To quantify these adjustments, appraisers look to a variety of studies conducted by practitioners and academics. As an example, a number of studies have been conducted to quantify the value of marketability/liquidity using data from initial public offerings (IPOs) and restricted stock.

Where can I get reliable valuation data for firms in the A/E and environmental consulting industries?

OK, I admit that this question is a self-served softball. But if you are looking for a source of reliable business valuation data compiled, analyzed and interpreted by accredited business appraisers with decades of experience within the A/E industry, we invite you to check out the aforementioned A/E Business Valuation and M&A Transactions Study. Better yet, if you participate in the confidential on-line survey, you’ll receive a $200 discount on the 2015 edition of this publication (to be released in January of 2015). To participate in the survey, simply follow this link www.rog-partners.com/aestudy.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms