Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

Are you destroying shareholder value?

Are you destroying shareholder value?

April 17, 2013

Most small businesses destroy shareholder value, rather than create it. This was the conclusion of a study by a well-respected business professor I recently heard lecture on the subject of small to mid-size business capital markets. The premise is simple. If your business cannot provide a return on investment equal to or greater than its cost of capital, it is destroying shareholder value. This theory raises many interesting questions for the small business owner/manager.

To answer the first question, we need to define the cost of capital, specifically the cost of equity capital that would apply to the typical small businesses in the A/E and environmental consulting industry. Without going into the gory details of capital asset pricing models, let’s just say that under current market conditions a typical cost of equity for a small, privately held A/E firm is around 18% (this rate could be significantly higher or lower for any given firm depending on its unique risk profile).

Now the test… If a company has a fair market equity value of $10 million, it would need to generate a return of over $1.8 million each year to theoretically “create shareholder value.” That return can consist of any combination of cash flow to shareholders and stock price appreciation.

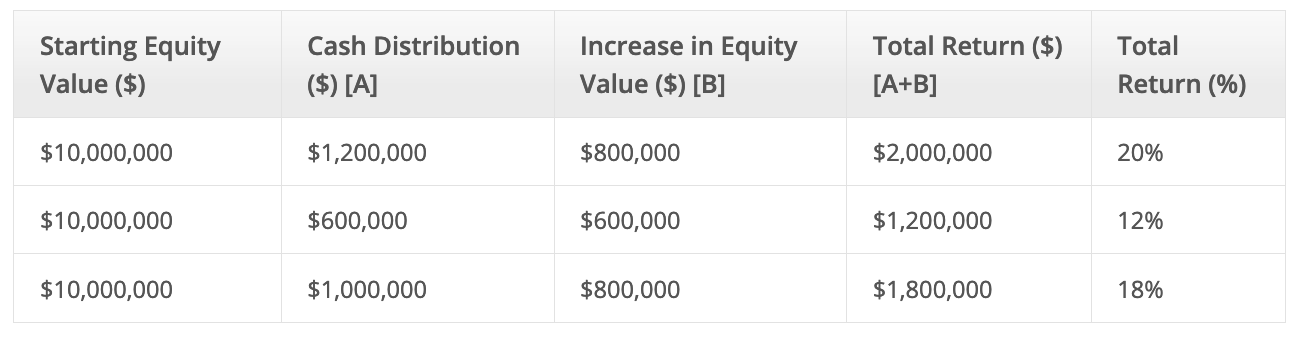

The table below illustrates three examples. In the first row, the combined return exceeds the cost of capital, creating shareholder value. In the second row, the combined return falls short of the cost of capital, destroying value. In the third row, the return equals the cost of capital, neither creating nor destroying value.

- Is this value destruction true of most A/E and environmental consulting firms?

- If it is true, then why do we have over 300,000 small business entities in these industries and how do these businesses continue to survive if in fact they destroy shareholder value?

- Are traditional capital models flawed in the way they define return on investment, cost of capital and value creation?

- Is creating value for shareholders the ONLY consideration in establishing and managing a business?

To answer the first question, we need to define the cost of capital, specifically the cost of equity capital that would apply to the typical small businesses in the A/E and environmental consulting industry. Without going into the gory details of capital asset pricing models, let’s just say that under current market conditions a typical cost of equity for a small, privately held A/E firm is around 18% (this rate could be significantly higher or lower for any given firm depending on its unique risk profile).

Now the test… If a company has a fair market equity value of $10 million, it would need to generate a return of over $1.8 million each year to theoretically “create shareholder value.” That return can consist of any combination of cash flow to shareholders and stock price appreciation.

The table below illustrates three examples. In the first row, the combined return exceeds the cost of capital, creating shareholder value. In the second row, the combined return falls short of the cost of capital, destroying value. In the third row, the return equals the cost of capital, neither creating nor destroying value.

Depending on which industry surveys you believe, the median EBITDA margin in the overall A/E and environmental consulting industry runs somewhere between 10% and 12% of net service revenue. Furthermore, some of those earnings will NOT be available for distribution to shareholders. After staff bonuses, working capital investment and fixed asset investment, available cash flow might be whittled down to as little as 5% of NSR. Let’s assume that our hypothetical firm generates $25 million in net service revenue (NSR) and $3.75 million in earnings before interest, taxes, depreciation and amortization (EBITDA). That equates to a 15% EBITDA margin—a pretty healthy profit by most standards. Such a firm should have no difficulty providing a return that exceeds its cost of capital. But what about the typical A/E firm?

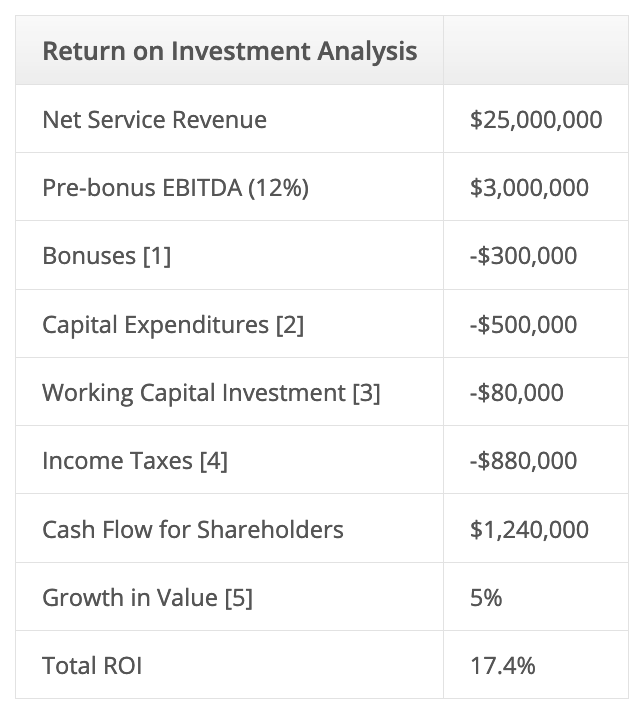

Now we can start to see how the theory of value destruction could very well be true for many firms. The following chart illustrates the total return on investment for a “typical” firm in the A/E industry, starting with an assumed EBITDA margin of 12%. We’ve used a number of other assumptions regarding staff bonuses, capital expenditures, working capital investment and taxes, all of which are footnoted below.

Now we can start to see how the theory of value destruction could very well be true for many firms. The following chart illustrates the total return on investment for a “typical” firm in the A/E industry, starting with an assumed EBITDA margin of 12%. We’ve used a number of other assumptions regarding staff bonuses, capital expenditures, working capital investment and taxes, all of which are footnoted below.

[1] Staff bonuses estimated at approximately 2% of total labor cost or 10% of EBITDA

[2] Capital expenditure estimated at 2% of net service revenue

[3] Working capital investment based on 5% revenue growth and a working capital turnover rate of 6x/year

[4] Income taxes estimated at 40% of taxable income, assuming depreciation expense equal to capital expenditures

[5] Growth in stock value is based on 5% growth in revenue and earnings.

If we assume a cost of capital for the hypothetical firm above of 18%, this firm comes close, but does not quite clear the hurdle rate for creating shareholder value. This suggests that there may in fact be more firms in the industry that theoretically destroy shareholder value rather than create it.

So if it IS true that many firms in the industry fail to create shareholder value, then why do they continue to exist? The nature of the professional services industry is one reason. Unlike other industries (e.g. manufacturing, retail, or high-tech) architecture, engineering and environmental firms are predominantly owned by practicing professionals. For these professionals, the business is not purely a financial investment, but is also their source of employment, and a vehicle for practicing their craft.

Furthermore, in privately held businesses it’s often difficult to segregate the owners’ compensation from their return on their investment, particularly in privately held C-corporations, where there is a strong aversion to declaring and paying dividends due to the double taxation of such distributions.

While I wouldn’t jump to the conclusion that traditional capital models are flawed as applied to small business, particularly professional service businesses, I do believe they fail to capture the less tangible returns—returns not easily measured in dollars and cents. Autonomy, job security, control over one’s own destiny, and pride of ownership are all factors that drive professionals to establish new firms, or buy into existing ones.

If an architect, engineer or scientist is able to create a business that fulfills such personal goals, while simultaneously serving a market need and creating jobs and livelihoods for other individuals, I would argue that he or she has “created value” in doing so, irrespective of the level of financial return.

That said, the ideal firm would create value in all of the above ways, while also achieving a level of financial return on investment that creates shareholder value. This would in turn attract additional financial investment in the firm, allowing the cycle to continue. As small business owners and managers, this is what we should all strive for.

[2] Capital expenditure estimated at 2% of net service revenue

[3] Working capital investment based on 5% revenue growth and a working capital turnover rate of 6x/year

[4] Income taxes estimated at 40% of taxable income, assuming depreciation expense equal to capital expenditures

[5] Growth in stock value is based on 5% growth in revenue and earnings.

If we assume a cost of capital for the hypothetical firm above of 18%, this firm comes close, but does not quite clear the hurdle rate for creating shareholder value. This suggests that there may in fact be more firms in the industry that theoretically destroy shareholder value rather than create it.

So if it IS true that many firms in the industry fail to create shareholder value, then why do they continue to exist? The nature of the professional services industry is one reason. Unlike other industries (e.g. manufacturing, retail, or high-tech) architecture, engineering and environmental firms are predominantly owned by practicing professionals. For these professionals, the business is not purely a financial investment, but is also their source of employment, and a vehicle for practicing their craft.

Furthermore, in privately held businesses it’s often difficult to segregate the owners’ compensation from their return on their investment, particularly in privately held C-corporations, where there is a strong aversion to declaring and paying dividends due to the double taxation of such distributions.

While I wouldn’t jump to the conclusion that traditional capital models are flawed as applied to small business, particularly professional service businesses, I do believe they fail to capture the less tangible returns—returns not easily measured in dollars and cents. Autonomy, job security, control over one’s own destiny, and pride of ownership are all factors that drive professionals to establish new firms, or buy into existing ones.

If an architect, engineer or scientist is able to create a business that fulfills such personal goals, while simultaneously serving a market need and creating jobs and livelihoods for other individuals, I would argue that he or she has “created value” in doing so, irrespective of the level of financial return.

That said, the ideal firm would create value in all of the above ways, while also achieving a level of financial return on investment that creates shareholder value. This would in turn attract additional financial investment in the firm, allowing the cycle to continue. As small business owners and managers, this is what we should all strive for.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms