Michael S. O'Brien is a principal in the Washington, DC office of Rusk O'Brien Gido + Partners. He specializes in corporate financial advisory services including business valuation, fairness and solvency opinions, mergers and acquisitions, internal ownership transition consulting, ESOPs, and strategic planning. Michael has consulted hundreds of architecture, engineering, environmental and construction companies across the U.S. and abroad.

Mitigating Taxes While Achieving Your Strategic Ownership Goals

Mitigating Taxes While Achieving Your Strategic Ownership Goals

August 7, 2017

In my experience, the top three reasons why A/E firms implement employee stock ownership plans (ESOPs) are taxes, taxes, and taxes. However, while mitigating taxes is an important element, a good ownership plan should be driven by a firm’s strategic plan and its long-term goals. An ownership plan that is exclusively focused on mitigating or eliminating taxes will rarely help a firm address its strategic goals. Strategic ownership goals might include aligning ownership with leadership, making the investment process affordable to new owners, and ensuring that the stock produces a healthy return on investment for all owners. The tax consequences of an ownership plan should be considered in the context of how they impact the firm’s ability to achieve its strategic ownership goals.

ESOPs have long been considered the panacea of tax efficiency when it comes to ownership transition, but not every firm is a good candidate for ESOP ownership, particularly if it does not address the firm’s strategic ownership goals. A few years ago, I stumbled upon an idea of creating an ownership model that has economic benefits similar to those of an ESOP, but is not as costly as an ESOP (implementation and operating) and does not require ownership to be shared with all employees. This ownership model uses common and synthetic securities with the former being valued at adjusted book value and latter having value that is similar to the goodwill value of the firm. On a combined basis, the value of these two securities will be similar to the fair market value of the company. The tax benefits of this plan can be significant – especially if your firm is very profitable. The key difference is that a shareholder will buy their shares and earn their synthetic equity.

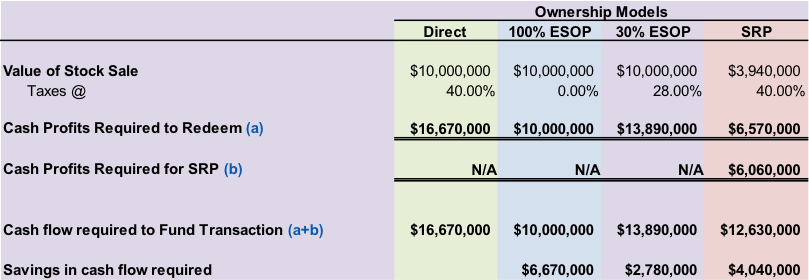

The table below demonstrates four ownership transition scenarios and a comparison of the required cash flow to redeem the same volume shares under each scenario. These are actual metrics of a client. In the example, the company’s book value is $3.94 million, its fair market value is $10.00 million and the assumed tax rate is 40%. We have compared the economic benefit of redeeming $10.00 million of value using a direct ownership model, a 100% ESOP ownership model, a 30% ESOP ownership model, and a SRP (Supplemental Retirement Plan) model, which uses both common and synthetic equity.

ESOPs have long been considered the panacea of tax efficiency when it comes to ownership transition, but not every firm is a good candidate for ESOP ownership, particularly if it does not address the firm’s strategic ownership goals. A few years ago, I stumbled upon an idea of creating an ownership model that has economic benefits similar to those of an ESOP, but is not as costly as an ESOP (implementation and operating) and does not require ownership to be shared with all employees. This ownership model uses common and synthetic securities with the former being valued at adjusted book value and latter having value that is similar to the goodwill value of the firm. On a combined basis, the value of these two securities will be similar to the fair market value of the company. The tax benefits of this plan can be significant – especially if your firm is very profitable. The key difference is that a shareholder will buy their shares and earn their synthetic equity.

The table below demonstrates four ownership transition scenarios and a comparison of the required cash flow to redeem the same volume shares under each scenario. These are actual metrics of a client. In the example, the company’s book value is $3.94 million, its fair market value is $10.00 million and the assumed tax rate is 40%. We have compared the economic benefit of redeeming $10.00 million of value using a direct ownership model, a 100% ESOP ownership model, a 30% ESOP ownership model, and a SRP (Supplemental Retirement Plan) model, which uses both common and synthetic equity.

The cost of redeeming $10.00 million in stock under the direct ownership model is $16.67 million, because the company has to generate enough profits to pay taxes so that it has $10 million left over to redeem the shares (net income/[1-tax rate]). Under a 100% ESOP model, the company would only have to generate $10 million in profits because at 100% ESOP ownership the company becomes a tax-free entity and is not subject to corporate taxes (the company is a subchapter S corporation). This savings significantly enhances the overall liquidity of the shares because of the tax efficiencies, which is why we have seen so many firms consider a 100% ESOP ownership model.

Under a 30% ESOP model, the company would have to generate $13.89 million in profits, paying taxes of $3.89 million in order to have $10 million remaining to redeem the shares. This explains why many firms adopt the partial ESOP ownership model. While the benefits are not as great as the 100% ESOP, is still represents significant tax savings over the direct ownership model.

Now let’s consider the SRP model. Assuming the shares are redeemed at book value and SRP units are redeemed at the difference between $10 million and $3.94 million ($6.57 million), the total cash flow required is $12.63 million. This is lower than the Direct and 30% ESOP models because the SRP units are tax deductible to the company (this security instrument takes on similar features to a deferred compensation plan). Additionally, the SRP model has some key benefits that go beyond the tax benefits described above. For example, creating an attractive return on investment is now easier because lower cash flow is required to yield greater returns. In this example, the company pays a 15% dividend on its common stock. At book value, the total dividend paid is $591,000. This makes the investment in common equity extremely attractive. Since the SRP component of this model can be a significant portion of the overall value to a shareholder, it is advisable that the SRP units vest over a long-period of time. This encourages long-term commitment on the part of the shareholders.

I will be presenting this ownership model in Los Angeles at a one-day Ownership Transition Strategies Seminar on September 19th and at our Growth & Ownership Conference in Naples this November. If you wish to understand how this SRP model can allow you to mitigate the tax consequences of ownership transition, while helping achieve your firm’s long-term goals, feel free to contact me.

Under a 30% ESOP model, the company would have to generate $13.89 million in profits, paying taxes of $3.89 million in order to have $10 million remaining to redeem the shares. This explains why many firms adopt the partial ESOP ownership model. While the benefits are not as great as the 100% ESOP, is still represents significant tax savings over the direct ownership model.

Now let’s consider the SRP model. Assuming the shares are redeemed at book value and SRP units are redeemed at the difference between $10 million and $3.94 million ($6.57 million), the total cash flow required is $12.63 million. This is lower than the Direct and 30% ESOP models because the SRP units are tax deductible to the company (this security instrument takes on similar features to a deferred compensation plan). Additionally, the SRP model has some key benefits that go beyond the tax benefits described above. For example, creating an attractive return on investment is now easier because lower cash flow is required to yield greater returns. In this example, the company pays a 15% dividend on its common stock. At book value, the total dividend paid is $591,000. This makes the investment in common equity extremely attractive. Since the SRP component of this model can be a significant portion of the overall value to a shareholder, it is advisable that the SRP units vest over a long-period of time. This encourages long-term commitment on the part of the shareholders.

I will be presenting this ownership model in Los Angeles at a one-day Ownership Transition Strategies Seminar on September 19th and at our Growth & Ownership Conference in Naples this November. If you wish to understand how this SRP model can allow you to mitigate the tax consequences of ownership transition, while helping achieve your firm’s long-term goals, feel free to contact me.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms