Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

New Study Reveals What People REALLY Pay for A/E Firm Stock

New Study Reveals What People REALLY Pay for A/E Firm Stock

January 30, 2014

If you were interested in buying a house, and the seller told you it was worth $1 million, would you take their word for it and write them a check. I certainly hope not. Ideally, you’d want to see an appraisal. At the very least you’d want to do some research to see what similar homes had actually sold for—what appraisers refer to as “comparable sales.”

Transacting stock in a privately held A/E or environmental consulting firm should be no different. As business appraisers and financial advisers, we make our living helping owners establish the value of their businesses, and transact stock either internally (to other employee-managers) or externally (through a strategic merger or acquisition). But we also realize that not every situation requires a full independent business appraisal. Sometimes all a business owner or a potential investor needs is some independent data on “comparable sales.”

While there are surveys of how firms in the industry value themselves and the formulas they use to do so, there has never been an in-depth study of actual transactions of stock between willing buyers and willing sellers in the A/E industry, UNTIL NOW.

Over the last six months we have been conducting a confidential survey of firms in the architecture, engineering and environmental consulting industry, as well as researching stock transactions in the public realm. The result is the 2014 A/E Business Valuation and M&A Transactions Study.

What makes this study unique is that we have incorporated ONLY data from actual transactions where consideration (cash, notes, earn-outs, etc.) has changed hands between willing buyers and willing sellers. The study examined data from over 200 distinct stock transactions collected via a confidential online survey. We have supplemented this with data collected from publicly available sources. All data was analyzed and compiled by accredited business appraisers with decades of experience valuing privately held A/E firms. The result is the most comprehensive and reliable study on business valuation ever published for the A/E and environmental consulting industries.

Transacting stock in a privately held A/E or environmental consulting firm should be no different. As business appraisers and financial advisers, we make our living helping owners establish the value of their businesses, and transact stock either internally (to other employee-managers) or externally (through a strategic merger or acquisition). But we also realize that not every situation requires a full independent business appraisal. Sometimes all a business owner or a potential investor needs is some independent data on “comparable sales.”

While there are surveys of how firms in the industry value themselves and the formulas they use to do so, there has never been an in-depth study of actual transactions of stock between willing buyers and willing sellers in the A/E industry, UNTIL NOW.

Over the last six months we have been conducting a confidential survey of firms in the architecture, engineering and environmental consulting industry, as well as researching stock transactions in the public realm. The result is the 2014 A/E Business Valuation and M&A Transactions Study.

What makes this study unique is that we have incorporated ONLY data from actual transactions where consideration (cash, notes, earn-outs, etc.) has changed hands between willing buyers and willing sellers. The study examined data from over 200 distinct stock transactions collected via a confidential online survey. We have supplemented this with data collected from publicly available sources. All data was analyzed and compiled by accredited business appraisers with decades of experience valuing privately held A/E firms. The result is the most comprehensive and reliable study on business valuation ever published for the A/E and environmental consulting industries.

Among other information, the study provides statistical data on the following valuation ratios or “multiples.”

- Enterprise Value / Gross Revenue

- Enterprise Value / Net Service Revenue

- Enterprise Value / Pre-bonus EBIT (earnings before interest & taxes)

- Enterprise Value / Pre-Owners’ Bonus EBIT

- Enterprise Value / Pre-bonus EBITDA (earnings before interest, taxes, depreciation & amortization)

- Enterprise Value / Pre-Owners’ Bonus EBITDA

- Enterprise Value / Number of Employees (full-time equivalent)

- Equity Value / Pre-Tax, Pre-Bonus Profit

- Equity Value / Pre-Tax, Pre-Owners’ Bonus Profit

- Equity Value / Book Value

Unlike any other surveys on the subject, this study examines the differences in valuation multiples between controlling and minority interest transactions, the difference in value between marketable stock (stock of publicly traded firms) and non-marketable stock (stock in privately held firms), and the valuation of stock in ESOP (employee stock ownership plan) transactions. Also provided is a statistical analysis of merger and acquisition deals—including how the transactions were structured, and the forms of consideration paid.

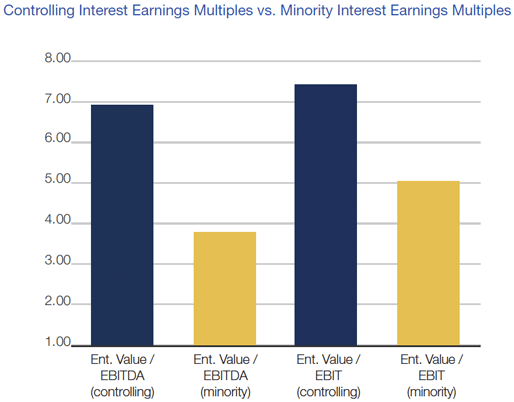

Data from this study begins to quantify concepts like the premium paid for controlling interests in A/E firms. For example, the survey, which includes statistics on 40 controlling interest M&A transactions revealed that earnings multiples in controlling interest transactions were 48% to 80% higher than corresponding earnings multiples in minority interest transactions.

Data from this study begins to quantify concepts like the premium paid for controlling interests in A/E firms. For example, the survey, which includes statistics on 40 controlling interest M&A transactions revealed that earnings multiples in controlling interest transactions were 48% to 80% higher than corresponding earnings multiples in minority interest transactions.

As a bonus, the collection of detailed income statement and balance sheet data from survey participants afforded the opportunity to calculate a wide variety of key financial performance metrics—19 in all. These financial metrics are also detailed in the study and include: net service revenue growth rates, various measures of profitability, staff utilization rates, labor multiplier rates, overhead rates, return on assets and return on equity, various balance sheet and leverage ratios, and more.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms