Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

The Tax Cuts and Jobs Act and Your Firm’s Value

The Tax Cuts and Jobs Act and Your Firm’s Value

January 9, 2018

On December 22nd, the Tax Cuts and Jobs Act (TCJA) was officially signed into law. Among the sweeping changes were substantial reductions in the corporate tax rate from a top marginal rate of 35%, to a flat 21%, along with an elimination of the corporate alternative minimum tax (AMT). This time last year we theorized about what a potential corporate tax rate cut might mean for company valuations. But now theory has become reality, with major implications for A/E firms across the U.S.

At the simplest level, profitable firms could see an increase in after-tax earnings of approximately 22%. The tables below illustrate the change in effective combined federal and state corporate tax rates for hypothetical firms in Iowa (one of highest corporate tax states), and in Wyoming (a state with no corporate income tax).

At the simplest level, profitable firms could see an increase in after-tax earnings of approximately 22%. The tables below illustrate the change in effective combined federal and state corporate tax rates for hypothetical firms in Iowa (one of highest corporate tax states), and in Wyoming (a state with no corporate income tax).

Estimated Combined Corporate Income Tax Rate Prior to TCJA

| Combined Corporate Tax Rate | (Iowa) |

|---|---|

| State Rate (highest marginal) | 12.0% |

| Tax-effected State Rate (A) | 7.8% |

| Federal Rate (highest marginal) (B) | 35.0% |

| Combined Effective Tax Rate (A+B) | 42.8% |

| Combined Corporate Tax Rate | (Wyoming) |

|---|---|

| State Rate | 0.0% |

| Tax-effected State Rate (A) | 0.0% |

| Federal Rate (highest marginal) (B) | 35.0% |

| Combined Effective Tax Rate (A+B) | 35.0% |

Estimated Combined Corporate Income Tax Rate After TCJA

| Combined Corporate Tax Rate | (Iowa) |

|---|---|

| State Rate (highest marginal) | 12.0% |

| Tax-effected State Rate (A) | 9.5% |

| Federal Rate (highest marginal) (B) | 21.0% |

| Combined Effective Tax Rate (A+B) | 30.5% |

| Combined Corporate Tax Rate | (Wyoming) |

|---|---|

| State Rate | 0.0% |

| Tax-effected State Rate (A) | 0.0% |

| Federal Rate (highest marginal) (B) | 21.0% |

| Combined Effective Tax Rate (A+B) | 21.0% |

Note that the above analysis assumes a C-corporation tax structure. The effective tax analysis for pass-through tax entities, including S-corporations and LLCs is much more complex, and will be the subject of a future Perspective.

All other things being equal, increased after-tax earnings would naturally lead to a commensurate increase in enterprise value (the value of a firm before consideration of its debt and cash balances), but business valuation is a bit more complex, and other factors, such as cost of capital, public company valuation multiples, and longer term economic trends must be considered.

With respect to the cost of capital, the TCJA puts limitations on the deductibility of interest expense. However, given that the typical firm in the A/E industry is lightly leveraged, this is unlikely to be a factor in most cases. The larger consideration will be whether baseline interest rates will increase in 2018, and by how much. In the latest meeting of the Federal Reserve’s Open Market Committee, the target range for the federal funds rate was increased by 0.25%. Inflationary concerns could spur further interest rate hikes in 2018, with the ultimate effect being a higher cost of capital, slightly offsetting the impact of increased earnings on company values.

As it relates to publicly traded firms, the perfect market theory would suggest that the cash flow impact of the TCJA is already accounted for in current market pricing. This seems to be supported by the broad expansion of the U.S. stock market over the past year. The Dow Jones Industrial Average has increased from 18,259 on November 7th, 2016 (immediately prior to the election), to 24,754 on December 22nd, (the date of the tax bill signing), which equates to an increase of 35.6%. Given that estimates for the Dow’s earnings per share for 2018 over 2017 suggest growth of only 11%, the market is clearly counting on significant incremental earnings benefits from the TCJA.

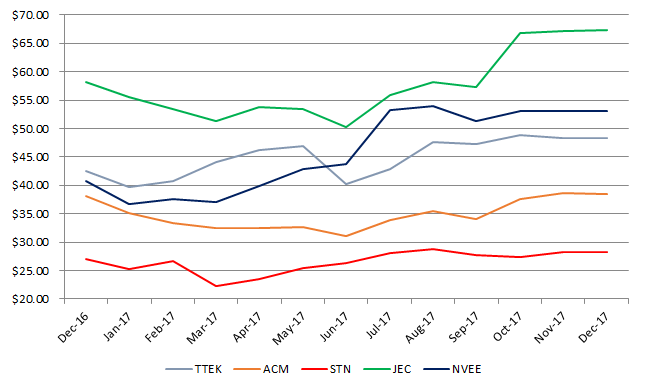

With respect to the narrower sector of publicly traded companies in the A/E industry, as the chart below indicates, these firms also saw stock price growth over the last year, with much of it coming in the final quarter of the year, which corresponds with the negotiation and eventual passage of the TCJA. The firms shown below include Tetra Tech (TTEK), AECOM (ACM), Stantec (STN), Jacobs Engineering (JEC) and NV5 Global (NVEE). We note that these firms have varying concentrations of earnings in the U.S., and therefore some will benefit more than others from a lower U.S. corporate tax rate.

All other things being equal, increased after-tax earnings would naturally lead to a commensurate increase in enterprise value (the value of a firm before consideration of its debt and cash balances), but business valuation is a bit more complex, and other factors, such as cost of capital, public company valuation multiples, and longer term economic trends must be considered.

With respect to the cost of capital, the TCJA puts limitations on the deductibility of interest expense. However, given that the typical firm in the A/E industry is lightly leveraged, this is unlikely to be a factor in most cases. The larger consideration will be whether baseline interest rates will increase in 2018, and by how much. In the latest meeting of the Federal Reserve’s Open Market Committee, the target range for the federal funds rate was increased by 0.25%. Inflationary concerns could spur further interest rate hikes in 2018, with the ultimate effect being a higher cost of capital, slightly offsetting the impact of increased earnings on company values.

As it relates to publicly traded firms, the perfect market theory would suggest that the cash flow impact of the TCJA is already accounted for in current market pricing. This seems to be supported by the broad expansion of the U.S. stock market over the past year. The Dow Jones Industrial Average has increased from 18,259 on November 7th, 2016 (immediately prior to the election), to 24,754 on December 22nd, (the date of the tax bill signing), which equates to an increase of 35.6%. Given that estimates for the Dow’s earnings per share for 2018 over 2017 suggest growth of only 11%, the market is clearly counting on significant incremental earnings benefits from the TCJA.

With respect to the narrower sector of publicly traded companies in the A/E industry, as the chart below indicates, these firms also saw stock price growth over the last year, with much of it coming in the final quarter of the year, which corresponds with the negotiation and eventual passage of the TCJA. The firms shown below include Tetra Tech (TTEK), AECOM (ACM), Stantec (STN), Jacobs Engineering (JEC) and NV5 Global (NVEE). We note that these firms have varying concentrations of earnings in the U.S., and therefore some will benefit more than others from a lower U.S. corporate tax rate.

AEC Publicly Traded Companies Share Price Trends

The impact of longer term operational and economic trends is more difficult to gauge. Some lingering questions include:

So in short, most firms should expect a material positive impact on their fair market value as a result of the TCJA. If you establish your firm’s value through the use of a professional business appraiser, he or she should be accounting for the impact of TCJA. If you are using another method to establish your firm’s value, such as a simple formula, this might be good time to re-assess that formula.

- Will the tax cuts spur an increase in economic growth as intended?

- Will further economic growth, combined with already low unemployment rates put significant upward pressure on wages (and downward pressure on operating profits)?

- If the next big legislative initiative is infrastructure, how will this impact A/E firm outlooks?

So in short, most firms should expect a material positive impact on their fair market value as a result of the TCJA. If you establish your firm’s value through the use of a professional business appraiser, he or she should be accounting for the impact of TCJA. If you are using another method to establish your firm’s value, such as a simple formula, this might be good time to re-assess that formula.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms