Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

Despite Indicators, A/E Sector May Avoid a Looming Economic Recession

May 22, 2023

All the usual warning signs point to a potential U.S. recession, beginning as early as Q3 of 2023. We have an inverted yield curve with short-term interest rates significantly exceeding long-term rates due to aggressive monetary policy actions by the Federal Reserve. The Federal Open Market Committee raised the Federal Funds rate 10 times during the last year—from 0.25 percent in May 2022 to its present level of 5.25 percent—to combat inflation. This had driven up short-term borrowing rates. The Wall Street Journal prime lending rate currently stands at 8.25 percent, up from 3.50 percent one year ago. The yield curve often is measured by the difference between the two-year U.S. Treasury and the 10-year U.S. Treasury. Periods of an inverted yield curve, where short-term interest rates exceed long-term rates, have invariably been followed by an economic recession.

Indeed, certain sectors of the economy already are showing signs of contraction. According to the latest Federal Reserve Beige Book report, U.S. manufacturing activity has slowed, banks have begun to tighten credit standards and capital investment by corporations has slowed. In the housing sector, the S&P/Case-Shiller U.S. National Home Price Index has been on the decline since July 2022, after a 10-year period of steady increase. Add in the specter of a looming debt-ceiling showdown in the U.S. Congress and the potential impact that default would have on the economy, and we have all the makings of a potential recession.

Bucking the Trends?

But in the face of these harbingers of a downturn, firms in the A/E sector are plowing ahead, posting growth in revenue and earnings as well as growing backlog levels. Anecdotally, as financial survey data come in from private A/E firms, they show most firms experienced significant revenue and earnings growth in 2022 (when earnings are adjusted to remove PPP loan income and employee retention tax credits) and, in many cases, record levels of contract backlog.

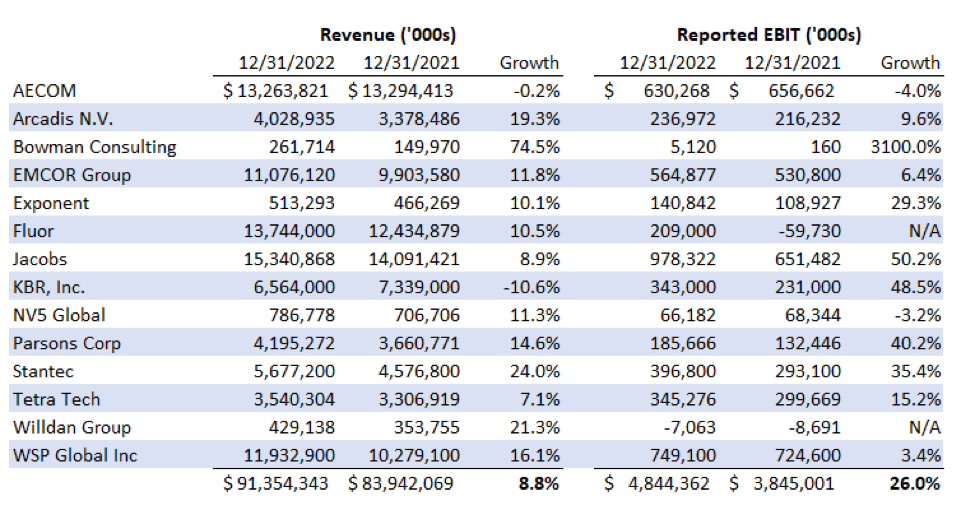

Data from the SEC filings of publicly traded companies in the A/E industry confirm the anecdotal observations. Analyzing the 2022 calendar year-end data from 14 publicly traded firms shows an average increase in revenue of 8.8 percent (weighted by dollar volume). And despite upward pressure on wages and the impact of inflation on other expenses, earnings increased at an even higher rate of 26.0 percent during the same period.

Table 1 illustrates the year-over-year change in gross revenue and earnings before interest and taxes (EBIT) for these firms (in thousands of dollars) as well as growth rate.

Of course, the market outlook could all change very quickly, but the increased volume of work under contract across the A/E industry, together with the sheer volume of federal spending through bills such as the Infrastructure Investment and Jobs Act (IIJA), suggests the sector may be insulated from a near-term recession—particularly the infrastructure sector and the public sector more broadly.

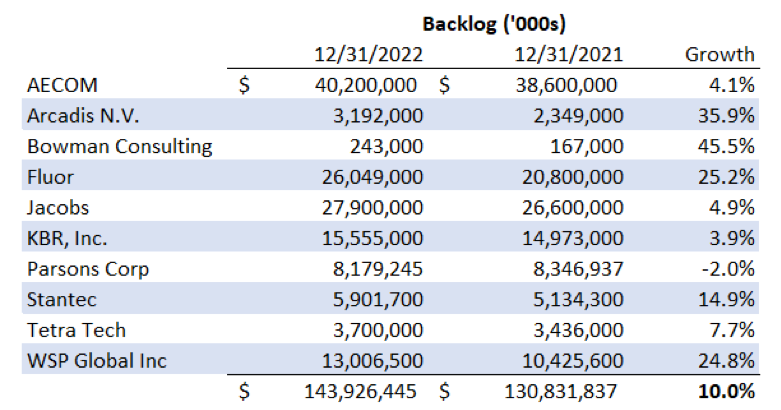

As illustrated in Table 2, of the 10 publicly traded firms reporting contract backlog data, nine out of 10 reported an increase year-over-year. On average, the weighted average backlog of these firms was up 10 percent over the prior year-end.

Although a recession appears to be imminent, the large backlog of federally funded work should provide a buffer for many firms, particularly those that are public sector-focused or at least well-diversified. Whether it will be enough to fully shield the industry from the impact of a prolonged recession remains to be seen. For now, 2023 is shaping up to be another strong growth year for A/E firms.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

Rusk O'Brien Gido + Partners, LLC