Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

Are architectural practices less valuable than engineering and environmental consulting firms?

Are architectural practices less valuable than engineering and environmental consulting firms?

January 16, 2015

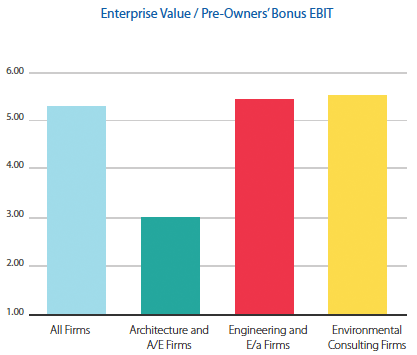

That seems to be what the data from the newly released 2015 A/E Business Valuation and Merger & Acquisition Transactions Study suggests.

The study, which examined actual stock transactions among A/E and environmental consulting firms nationwide over the last three years (over 230 in all) showed a notable difference between valuation multiples (specifically earnings multiples) of architecture firms, and those of engineering and environmental consulting firms.

The study, which examined actual stock transactions among A/E and environmental consulting firms nationwide over the last three years (over 230 in all) showed a notable difference between valuation multiples (specifically earnings multiples) of architecture firms, and those of engineering and environmental consulting firms.

Other valuation multiples showed a similar difference. But architectural firm owners shouldn’t lose heart. “One or two valuation multiples don’t always tell the whole story” cautions accredited business appraiser and contributing editor to the study, Ian Rusk. “Financial performance metric data from the study also showed that the participating architecture firms had some of the highest profit margins in the sample, and the values of those firms on a per employee basis were some of the highest.”

Developed in cooperation with the National Center for Employee Ownership (NCEO) and Business Valuation Resources (BVR), the 2015 A/E Business Valuation and M&A Transactions Study, now in its second edition, is sthe only true study of actual ownership transactions in the industry. It examines the actual prices at which ownership interests of firms in the industry have changed hands, including internal transactions, ESOP transactions, and strategic mergers and acquisitions.

The study also examines the pricing trends among publicly traded A/E firms, and presents all the data, segmented by transaction type, firm type, etc. The study also includes an analysis of how M&A transactions are structured as well as 19 separate financial performance benchmarking ratios derived from the participating firms, all broken down by firm type.

“This study is like several unique surveys in one. It’s a source of true ‘comparable sales’ data for business valuation professionals, it can be used by business owners to benchmark the value of their own firms, it’s a source of market data on controlling interest values and deal structures for firms considering a merger or acquisition, AND it can be used as a source of financial performance benchmarking data” says Rusk.

The 2015 A/E Business Valuation and M&A Transactions Study is available for online purchase at www.rog-partners/aestudy. Or for more information, call Michael Kearney at 617-274-8051 ext 508.

Developed in cooperation with the National Center for Employee Ownership (NCEO) and Business Valuation Resources (BVR), the 2015 A/E Business Valuation and M&A Transactions Study, now in its second edition, is sthe only true study of actual ownership transactions in the industry. It examines the actual prices at which ownership interests of firms in the industry have changed hands, including internal transactions, ESOP transactions, and strategic mergers and acquisitions.

The study also examines the pricing trends among publicly traded A/E firms, and presents all the data, segmented by transaction type, firm type, etc. The study also includes an analysis of how M&A transactions are structured as well as 19 separate financial performance benchmarking ratios derived from the participating firms, all broken down by firm type.

“This study is like several unique surveys in one. It’s a source of true ‘comparable sales’ data for business valuation professionals, it can be used by business owners to benchmark the value of their own firms, it’s a source of market data on controlling interest values and deal structures for firms considering a merger or acquisition, AND it can be used as a source of financial performance benchmarking data” says Rusk.

The 2015 A/E Business Valuation and M&A Transactions Study is available for online purchase at www.rog-partners/aestudy. Or for more information, call Michael Kearney at 617-274-8051 ext 508.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms