Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

Newly Released A/E Business Valuation and M&A Transactions Study Shows Peak Performance

| Financial Metrics | FY 2019 | FY 2018 | FY 2017 |

|---|---|---|---|

| NSR Growth (CAGR) | 9.6% | 9.2% | 6.8% |

| EBITDA / NSR | 15.4% | 15.1% | 14.1% |

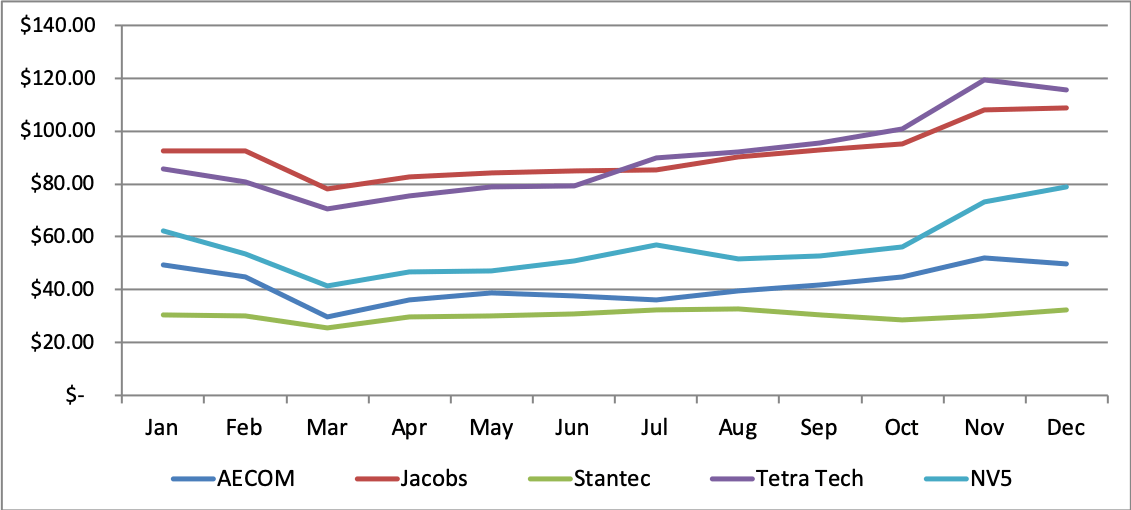

Select Publicly Traded A/E Firm Historical Share Prices - 2020

In terms of valuation metrics, the enterprise values of the ten public firms measured as a multiple of EBIT and EBITDA over the latest twelve months ended December 31, 2020 were up relative to the previous three fiscal year ends (note many of the public firms have fiscal years ending on September 30).

| Median Valuation Multiples | LTM 2020 | FY 2019 | FY 2018 | FY 2017 |

|---|---|---|---|---|

| Enterprise Value / EBITDA | 13.5x | 9.5x | 9.3x | 10.4x |

| Enterprise Value / EBIT | 16.3x | 14.4x | 12.9x | 14.6x |

As we begin to collect data on calendar year 2020 and Q1 2021 performance, I believe we will see further evidence of the resilience of the A/E sector to the sorts of business interruption caused by the COVID-19 pandemic. Technologies already adopted by most firms allow professionals to work from remote locations, collaborate with project teams and conduct meetings via video conference. Yet to be seen is how many of the adaptations made in response to the pandemic will be permanent, and if the industry will benefit in the long-term from some of these increased efficiencies.

The eighth edition of the A/E Business Valuation and M&A Transactions Study can be ordered online here.

And don’t miss the upcoming webinar on February 9th, Enhancing Design Firm Value through Profitability and Effective Business Management presented in collaboration with Berkley DP. Click here for more information and to register.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

Rusk O'Brien Gido + Partners, LLC