Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

The latest trends in A/E stock valuation and M&A pricing

The latest trends in A/E stock valuation and M&A pricing

February 14, 2019

Rusk O’Brien Gido + Partners, LLC recently released its annually updated A/E Business Valuation and M&A Transactions Study. Data from the sixth edition study shows remarkable stability in valuations of minority interests in privately held A/E and environmental consulting firms. As illustrated below, enterprise values as a multiple of gross revenue, net service revenue, and pre-bonus earnings before interest and taxes (EBIT) were virtually unchanged from 2017 to 2018.

| Minority Interests in Privately Held Companies | 2017 | 2018 |

|---|---|---|

| Median Enterprise Value / Gross Revenue | 38.3% | 38.2% |

| Median Enterprise Value / Net Service Revenue | 47.6% | 47.6% |

| Median Enterprise Value / Pre-bonus EBIT | 3.98 | 3.87 |

This is not too surprising given the general economic stability in the U.S., similar interest rate environment, and steady financial performance across the industry. The study shows that key financial performance metrics such as labor multiplier, labor utilization (billability) and overhead rate across the industry were very consistent from the prior year. In short, firms in the A/E and environmental consulting industry posted consistently strong financial performance, with fully utilized labor resources, good demand for their services and healthy profit margins. Anecdotally, the most commonly cited concern among firm leaders was the difficulty in recruiting and retaining talented and experienced staff.

Steady economic conditions have also continued to drive merger & acquisition activity. The volume of M&A transactions in 2018 was up considerably from the prior years. Our tracking data indicates that 311 mergers or acquisitions were closed in 2018, versus 250 in 2017 and 253 in 2016. This increase in deal activity appears to have had a slightly positive impact on deal valuations and deal structure. Our sixth edition of the study shows that median valuations as a percentage of revenue and as a multiple of EBIT both increased in 2018.

Steady economic conditions have also continued to drive merger & acquisition activity. The volume of M&A transactions in 2018 was up considerably from the prior years. Our tracking data indicates that 311 mergers or acquisitions were closed in 2018, versus 250 in 2017 and 253 in 2016. This increase in deal activity appears to have had a slightly positive impact on deal valuations and deal structure. Our sixth edition of the study shows that median valuations as a percentage of revenue and as a multiple of EBIT both increased in 2018.

| Controlling Interests in Privately Held Companies | 2017 | 2018 |

|---|---|---|

| Median Enterprise Value / Gross Revenue | 60.0% | 63.0% |

| Median Enterprise Value / Pre-bonus EBIT | 5.9 | 6.2 |

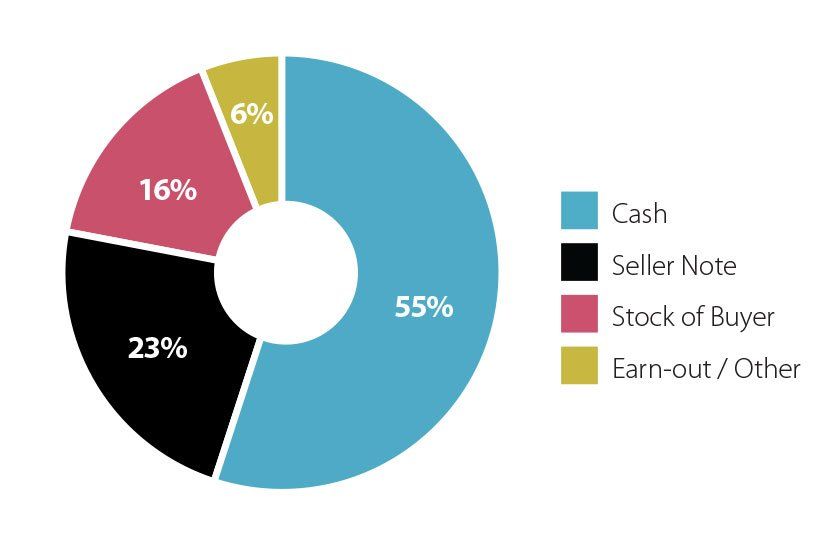

Deal structures shifted slightly as well, with less “at risk” consideration in the form of earn-outs and other contingent payments. The chart below illustrates the overall breakdown of consideration paid from the latest study.

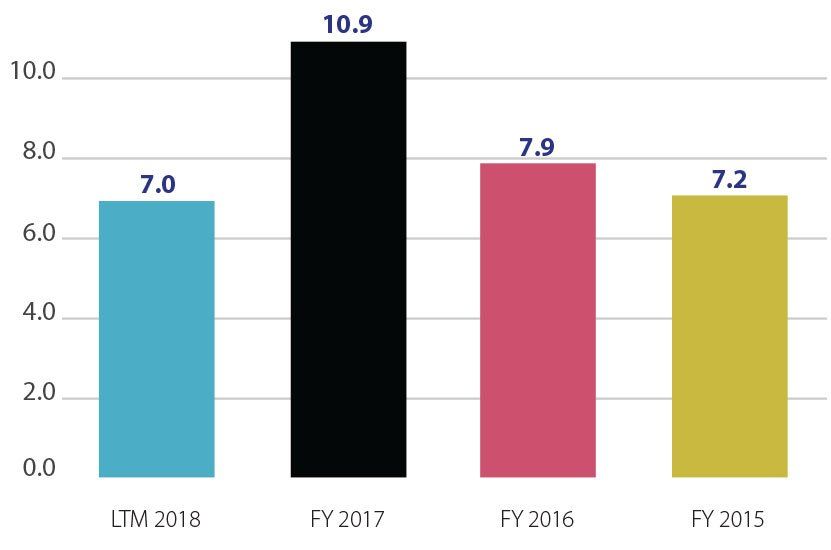

At the same time, valuations of publicly traded firms have fallen back to historical norms after a spike at year-end 2017. Valuations for many public traded firms hit a high point relative to revenue and earnings at that time in anticipation of corporate tax reform and a potential infrastructure spending bill. The following chart shows the historical enterprise value as a multiple of EBITDA for the combined 11 publicly traded A/E and environmental consulting firms (weighted by revenue levels) tracked by the study.

The A/E Business Valuation and M&A Transactions Study (6th Edition) contains ten valuation multiples calculated and broken down by firm type and detailed by statistical median, mean, trimmed mean, upper and lower quartile. As referenced above it includes data on privately held firms, ESOP-sponsoring companies, publicly traded firms, and merger & acquisition transactions. The study also contains a statistical analysis of 19 distinct financial condition and operating metrics.

The study is available for only $399 – click HERE to purchase.

The study is available for only $399 – click HERE to purchase.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms