With nearly fifteen years of corporate financial advisory experience, Jonathan Voelkel has worked with hundreds of engineering, architecture, and environmental consulting firms across the U.S. and abroad, in all facets of mergers & acquisitions, valuation, ownership transition planning, equity incentive compensation, and ESOP advisory. Jonathan received his Bachelor of Arts (BA) degree in Economics from Johns Hopkins University.

Why Are Firms Valued Lower When Selling Internally Versus Externally?

Why Are Firms Valued Lower When Selling Internally Versus Externally?

April 11, 2018

I’ve spoken with countless, exasperated A/E firm owners over the years who’ve asked me why their firm’s internal valuation doesn’t reflect a number similar to what they believe they can reasonably expect from an external sale. Most, but not all of the time, they’re first generation owners who are not sure why they’re expected to sell shares internally at a discount to what they might receive on a pro rata basis if their company were to sell to an outside acquirer.

Understanding the various levels of value can go a long way in helping guide expectations for firm owners and potential owners alike, and in this perspective, I’ll provide a fundamental explanation of each level of value with the hope of demystifying some common misconceptions.

Understanding the various levels of value can go a long way in helping guide expectations for firm owners and potential owners alike, and in this perspective, I’ll provide a fundamental explanation of each level of value with the hope of demystifying some common misconceptions.

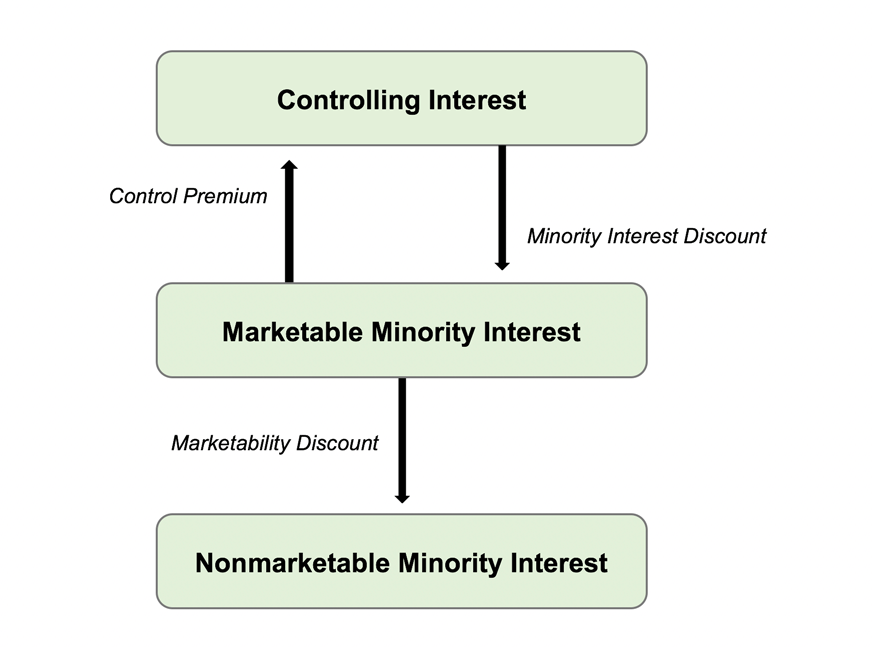

A firm’s valuation will vary significantly based on the level of the interest being valued. The differences in levels reflect the risk of achieving two things: expected cash flows and expected growth.

Starting with the highest level of value – control – a controlling interest stake affords its ownership the right to exert control over key business decisions that it believes will allow it to improve earnings and increase growth prospects. As such, there is a premium associated with what an acquirer believes it will be able to generate in terms of future cash flows and top-line growth that is represented in a control premium paid to gain those future benefits. When AECOM acquired URS in 2014, it paid $56.31 per share, a number that represented a 19% premium over the trailing 30-day average closing URS share price. This premium was what AECOM paid to gain control of URS.

The level immediately below control is marketable minority, which is the most straightforward level of value. When you purchase shares of AECOM, you become a minority shareholder of AECOM; those shares are unrestricted, which means that you have the ability to monetize those shares quickly at a marginal cost in an open market with multiple buyers and sellers. What you don’t have as a minority interest owner, however, is the ability to make any business decisions on behalf of AECOM. This lack of influence over a Company’s decision-making process is reflected in the discount for lack of control (“DLOC”). We often see DLOCs in the range of ~10% to ~30% with our clients.

But the level of interest relevant for almost all privately-held companies, especially those that have an internal market for shares – the non-marketable minority interest – dictates that yet one more discount be considered. Unlike your shares in AECOM, owners of non-marketable minority interests aren’t able to quickly convert their shares to cash without risking a significant loss in value. Publicly-traded stocks aren’t subject to this holding-period risk, while privately-held company shares are, since there is no readily available market in which shares can be transacted. Additionally, a blockage discount is a byproduct of the illiquidity associated with this level of interest. This discount may further decrease value based on whether the block of shares being transacted is so great that in order for a timely transaction to occur, the price of the shares must be discounted.

These inherent restrictions associated with a privately-held ownership interest dictate that there be a discount to reflect the illiquid nature of such an interest. This discount is known as the discount for lack of marketability (“DLOM”). DLOMs for firms (non-ESOP) we work with are generally between ~20% to ~40%.

Final Thoughts

While the basic tenets of the various levels of value apply to almost all firms, there are two types of firms I encounter regularly for which additional consideration and planning are required to ensure successful transitions, internally or externally. The first type are the firms who buck industry performance trends…in a good way, that is. Regardless of what’s occurring in local, national or global economies, their profit margins are consistently high during a downturn and even higher when the economy is booming. These firms usually see a smaller gap between what they might transact at internally versus what they might command in an external acquisition.

The other type of firm is one that relies on a material portion of its revenues from set-aside contracts. These firms, regardless of whether they’re performing below, at, or above industry medians, can quite often trade at a higher price internally than they could reasonably expect to get from an acquirer.

There is no “one size fits all” approach to determining and applying discounts or premiums. Although all shareholders benefit from the various perquisites of ownership, the extent of such benefits can vary widely, especially based on what level of value best represents their ownership interest.

Starting with the highest level of value – control – a controlling interest stake affords its ownership the right to exert control over key business decisions that it believes will allow it to improve earnings and increase growth prospects. As such, there is a premium associated with what an acquirer believes it will be able to generate in terms of future cash flows and top-line growth that is represented in a control premium paid to gain those future benefits. When AECOM acquired URS in 2014, it paid $56.31 per share, a number that represented a 19% premium over the trailing 30-day average closing URS share price. This premium was what AECOM paid to gain control of URS.

The level immediately below control is marketable minority, which is the most straightforward level of value. When you purchase shares of AECOM, you become a minority shareholder of AECOM; those shares are unrestricted, which means that you have the ability to monetize those shares quickly at a marginal cost in an open market with multiple buyers and sellers. What you don’t have as a minority interest owner, however, is the ability to make any business decisions on behalf of AECOM. This lack of influence over a Company’s decision-making process is reflected in the discount for lack of control (“DLOC”). We often see DLOCs in the range of ~10% to ~30% with our clients.

But the level of interest relevant for almost all privately-held companies, especially those that have an internal market for shares – the non-marketable minority interest – dictates that yet one more discount be considered. Unlike your shares in AECOM, owners of non-marketable minority interests aren’t able to quickly convert their shares to cash without risking a significant loss in value. Publicly-traded stocks aren’t subject to this holding-period risk, while privately-held company shares are, since there is no readily available market in which shares can be transacted. Additionally, a blockage discount is a byproduct of the illiquidity associated with this level of interest. This discount may further decrease value based on whether the block of shares being transacted is so great that in order for a timely transaction to occur, the price of the shares must be discounted.

These inherent restrictions associated with a privately-held ownership interest dictate that there be a discount to reflect the illiquid nature of such an interest. This discount is known as the discount for lack of marketability (“DLOM”). DLOMs for firms (non-ESOP) we work with are generally between ~20% to ~40%.

Final Thoughts

While the basic tenets of the various levels of value apply to almost all firms, there are two types of firms I encounter regularly for which additional consideration and planning are required to ensure successful transitions, internally or externally. The first type are the firms who buck industry performance trends…in a good way, that is. Regardless of what’s occurring in local, national or global economies, their profit margins are consistently high during a downturn and even higher when the economy is booming. These firms usually see a smaller gap between what they might transact at internally versus what they might command in an external acquisition.

The other type of firm is one that relies on a material portion of its revenues from set-aside contracts. These firms, regardless of whether they’re performing below, at, or above industry medians, can quite often trade at a higher price internally than they could reasonably expect to get from an acquirer.

There is no “one size fits all” approach to determining and applying discounts or premiums. Although all shareholders benefit from the various perquisites of ownership, the extent of such benefits can vary widely, especially based on what level of value best represents their ownership interest.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms