Steve Gido is one of the A/E industry’s leading M&A advisors. For over twenty years, he has served as trusted counsel to founders, owners, executives and boards of directors in pursuing both growth and exit strategy options. Over the course of his career, he has advised on a wide number of A/E transactions, representing both buyers and sellers of all sizes and disciplines.

Can the Conventional A/E Internal Transition Make a Comeback?

March 12, 2025

Sometimes, business structures and models endure over generations, and occasionally, they fight to stay relevant. For as long as anyone can remember, the reliable internal ownership transition, in all its subtle nuances and variations, has served as both the primary mechanism for exit strategy planning and a symbol of “making it” in the profession. Harking back to an apprenticeship approach of centuries ago, young designers would hone their craft under the tutelage of their senior practitioners. The exemplary ones would ultimately be asked to join as Associates and blocks of company stock would be seamlessly bought and sold between those young and old. It ensured a steadfast method to maintain a company’s legacy and values as well as binding those together in good times and in bad. However, as we are witnessing, this traditional path may struggle to last in today’s modern A/E landscape.

For the past 25 years, the A/E industry has been consolidating. And the last five years have seen an astonishing ramp-up in M&A activity, with over 2,200 North American A/E and environmental consulting transactions. Clearly, leaders are choosing to sell out vs. sell down. We’re all generally aware of the reasons. Higher valuations. Recruiting and retention challenges. Scale can be a differentiator. Private equity impacts and aggressive serial buyers. However, in most instances of why an external sale took place, it’s the selling owners who lament, “I would have loved to transition the firm internally, but no one here wants to buy me out.”

Incidentally, the dilemma of internal transition vs. third-party sale isn’t just an issue for small A/E firms or a few owners with concentrated stakes. Many ENR 500 firms comprised of broad ownership profiles have been selling to large strategic buyers and private equity firms for years. And while there is a steady uptick each year in the number of A/E firms who implement an ESOP, there are just as many employee-owned firms who choose to sell out (by our count, four in the last six months!). For all the societal benefits we hear about ownership in general, anecdotally it feels like our industry is constricting ownership opportunities, not expanding them. What gives?

To be sure, there are still thousands of A/E firms with well-functioning internal transition programs. In some cases, they were established decades ago and have been continually championed by leaders who have chosen independence over losing control. A growing number of Gen X and Millennial founders are open to adding partners as a means of retention, motivation, and higher rewards in a relentless war for talent. But even the most durable plans and intentions are always subject to changing business conditions, competitive shifts, outside inquiries, and tempting offers.

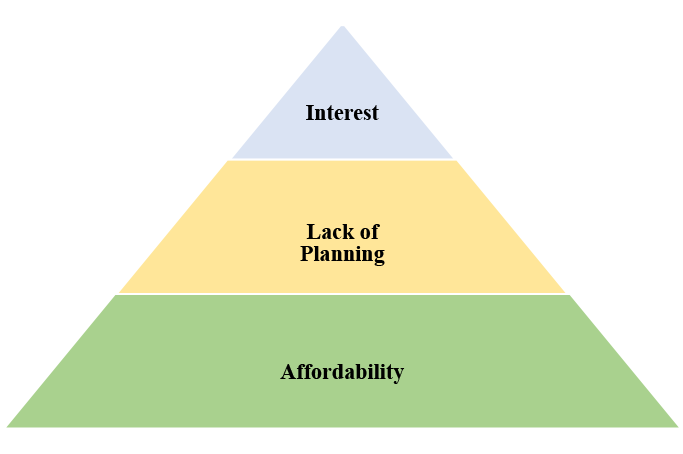

In our experience, we note three main challenges slowing the implementation of internal transfer strategies. As the chart below illustrates, those are: Affordability, Lack of Planning, and Interest.

Affordability – Let’s start with an obvious one at the base. There are plenty of strains on young people’s finances. High student loan debt. Expensive homes and rents. Raising kids and childcare demands. Keeping pace with inflation for basic goods and services. Asking this generation to then buy into a firm’s stock program may be an unrealistic stretch. As the value of A/E firms has soared over the last five years, some junior employees may question the value proposition compared to their older partners who bought in at much lower levels.

Lack of Planning – We frequently speak with successful A/E owners and entrepreneurs later in their careers who wished they had planned earlier for better exit or succession options. It happens. We all get caught up in the daily activities of managing projects, confronting the unexpected, and winning over clients, and this undertaking gets pushed back. Oftentimes, founders are unsure exactly how to go about implementing or modifying a program that fits their organization or will avoid uncomfortable conversations with staff members on the subject. The problem is that as years go by, the lack of clear direction can become a burdensome issue for the firm’s overall viability. Employees and clients alike wonder how long the firm’s senior leaders will keep working.

Interest – Interest in becoming an owner, or conversely, selling down one’s ownership stake can be a two-way street. A common refrain we hear from Baby Boomer owners has been, “I’ve raised the topic of ownership up to various team members, but no one is interested.” That is certainly understandable as many professionals simply enjoy being engineers, architects, scientists, or surveyors and never had any genuine aspiration to own anything, or privately, they don’t want to be tied to their employer if a better opportunity comes along. Similarly, given record levels of growth and profitability at A/E firms, some older owners have been in no hurry to sell their shares. For them, this period has ushered in high bonuses, dividends, and perquisites that they are not quite ready to give up

So, how can internal transitions adapt to an evolving A/E environment? Can they regain traction and acceptance in an M&A Supercycle era? Five suggestions:

- Internal transitions involve sharing and sacrifice – Ideally, these models build wealth over time through patient capital gains, dividends/distributions, and/or deferred compensation. Given affordability issues, the company itself will often need to serve as the conduit for financing and liquidity for those buying in and others cashing out.

- Trust and transparency are critical – Open book management and a frank discussion of the potential risks and rewards build buy-in. Tying equity stakes to the company’s mission and values will help drive incentives and performance.

- Governance is separate from ownership – Selling shares to junior partners doesn’t mean everyone has an equal voice at the table. Recognize the distinction between leadership and ownership.

- Promote its benefits and cultivate prospects – Regardless of the firm’s generation, growth requires leaders to continually advocate the importance of adding new partners. Grooming and mentoring staff are key to their professional development and advancing their careers.

- Assess your ownership situation every year – Just like your strategic plan or financial budget, A/E leaders should annually review their shareholder profile and related documents. That includes assessing current repurchase obligations, looming retirements, buy-sell agreements, and stock formulas.

* * *

At ROG+ Partners, we assist A/E organizations of all sizes in navigating a range of strategic and ownership alternatives. We advise leaders on a range of internal and external transition tactics, from conventional to creative.