Steve Gido specializes in corporate financial advisory services with a focus on mergers and acquisitions. Steve has assisted architecture, engineering, environmental consulting and construction firms of all sizes across North America achieve their growth or liquidity goals through successful mergers & acquisitions. Steve has over 15 years of investment banking experience and holds the chartered financial analyst (CFA) designation from the CFA Institute.

Five Key Observations on 2013 A/E M&A Activity

December 4, 2013

Buyers and sellers who spent 2013 participating in and closing various mergers and acquisitions may be asking Santa for a smooth integration, a rising stock price, or perhaps just some extra help hitting that earnout milestone. And if you’re gearing up for 2014, start making that list as old Kris Kringle is always watching. So for those who have been both naughty and nice, we thought we would reflect on some of the key themes and trends on A/E M&A activity this past year.

1. The overall number of deals is down slightly this year – As we forecast back in the spring, the number of industry transactions through November is down (roughly 13%) from 2012 levels. We chalk this up to several reasons, including a sizable number of 2012 deals driven by tax motivations, a desire for some buyers to digest and integrate targets, wider gaps in valuation between parties, and the general lack of “mega-deals.” In fact, while Michael Baker going private and Jacobs acquiring Australia’s SKM made for interesting headlines, the truth is that large players sat 2013 out.

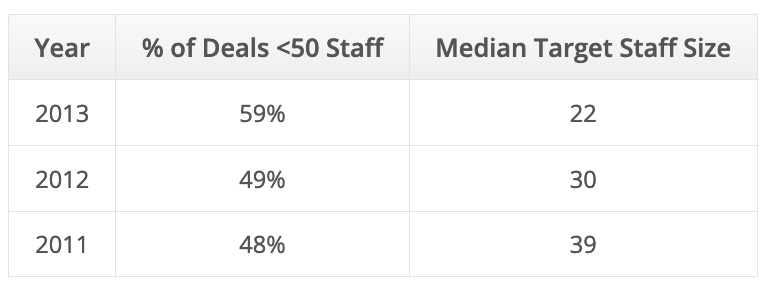

2. More small A/E firms are choosing to sell – There has been a pronounced trend of smaller firms electing to sell to strategic buyers over the last three years. As the chart below shows, the percentage of transactions in which the seller had fewer than 50 total staff members has risen, while the median acquired firm’s staff size has declined. And while fewer mega combinations explain part of this trend, other contributing factors include buyers seeking specific service/market niches (which tend to be smaller than multi-disciplined firms), and the plain fact that many firms have shrunk from their peak size of 4 to 5 years ago. We have also encountered mid-sized firms who have decided to “hang in there” and remain independent rather than exploring a possible sale. This is not to suggest that smaller firms are necessarily in greater demand – it is still the case that mid-sized and larger firms attract great interest among the most active buyers in the marketplace.

1. The overall number of deals is down slightly this year – As we forecast back in the spring, the number of industry transactions through November is down (roughly 13%) from 2012 levels. We chalk this up to several reasons, including a sizable number of 2012 deals driven by tax motivations, a desire for some buyers to digest and integrate targets, wider gaps in valuation between parties, and the general lack of “mega-deals.” In fact, while Michael Baker going private and Jacobs acquiring Australia’s SKM made for interesting headlines, the truth is that large players sat 2013 out.

2. More small A/E firms are choosing to sell – There has been a pronounced trend of smaller firms electing to sell to strategic buyers over the last three years. As the chart below shows, the percentage of transactions in which the seller had fewer than 50 total staff members has risen, while the median acquired firm’s staff size has declined. And while fewer mega combinations explain part of this trend, other contributing factors include buyers seeking specific service/market niches (which tend to be smaller than multi-disciplined firms), and the plain fact that many firms have shrunk from their peak size of 4 to 5 years ago. We have also encountered mid-sized firms who have decided to “hang in there” and remain independent rather than exploring a possible sale. This is not to suggest that smaller firms are necessarily in greater demand – it is still the case that mid-sized and larger firms attract great interest among the most active buyers in the marketplace.

3. Firms with aggressive growth goals will need M&A to achieve them

– Many firms have had a strong 2013 and are looking to build on that. We’ve been pleasantly surprised with the number of organizations, of all shapes and sizes, that have shared with us their eyebrow-raising BHAGs (Big Hairy Audacious Goals). In some cases, they want to double or triple their revenue over the next 5 to 7 years. Kudos for the moxie! The fundamental challenge, however, is that by even the most optimistic projections, U.S. economic growth over the next few years is likely to remain tepid. Ditto for our sector. Doubling your firm in 5 years is certainly possible if you are in the “right” part of the country or hot market (North Dakota shale or Gulf Coast industrial anyone?). But good luck finding scarce talent as demographic challenges will continue to be headwinds for the A/E sector. As a result, with organic growth elusive or uneven, many organizations will ramp up acquisition programs, search efforts, and courtship discussions to maintain a viable pipeline of target firms to acquire and integrate.

4. Sellers are back to traditional motivations – For the last 4 years, two underlying trends have driven a number of A/E owners to sell their firms. The first was survivability. With the deep design recession, some unfortunate organizations were financially distressed, operationally impaired, or otherwise technically insolvent, and simply needed a lifeline to avoid going under. Buyers scooped up select assets, contracts, and/or personnel, often for little to no value. The other pursuit was tax minimization. While owners don’t sell their firm solely to save a few points from Uncle Sam, for those on the fence, locking in lower capital gains rates was certainly a factor. Today, with healthier operational conditions and the tax climate generally set, sellers are driven by traditional challenges such as age or health matters, ownership transition challenges, leadership succession issues, and a relentless competitive environment. In addition, more owners considering a sale today can point to 3 years of improved growth and profitability as well as a growing backlog, thus offering a better “story” and enhanced valuation prospects to potential suitors.

5. Valuations are resilient, yet target specific – We’ve been encouraged that sale multiples, in aggregate, have remained solid over the last year. That being said, in a fragmented A/E and environmental consulting market, today’s prices are more dependent than ever on a breadth of target specific attributes. Those include market sector/client base, firm size, growth rates, synergistic qualities, geographic locations, revenue diversity, depth of management team, and, of course, profitability. As always, managing expectations and minimizing surprises is half the battle going into the process.

At Rusk O’Brien Gido + Partners, we possess strong relationships and years of experience navigating A/E and environmental buyers and sellers through the M&A process and towards winning combinations. Whether you are seeking to grow through acquisitions or by evaluating your firm’s strategic and ownership alternatives, please contact us as to how we can help your organization.

On a final note, Season’s Greetings and a Happy, Healthy and Prosperous New Year from all of us here at ROG+ Partners!

4. Sellers are back to traditional motivations – For the last 4 years, two underlying trends have driven a number of A/E owners to sell their firms. The first was survivability. With the deep design recession, some unfortunate organizations were financially distressed, operationally impaired, or otherwise technically insolvent, and simply needed a lifeline to avoid going under. Buyers scooped up select assets, contracts, and/or personnel, often for little to no value. The other pursuit was tax minimization. While owners don’t sell their firm solely to save a few points from Uncle Sam, for those on the fence, locking in lower capital gains rates was certainly a factor. Today, with healthier operational conditions and the tax climate generally set, sellers are driven by traditional challenges such as age or health matters, ownership transition challenges, leadership succession issues, and a relentless competitive environment. In addition, more owners considering a sale today can point to 3 years of improved growth and profitability as well as a growing backlog, thus offering a better “story” and enhanced valuation prospects to potential suitors.

5. Valuations are resilient, yet target specific – We’ve been encouraged that sale multiples, in aggregate, have remained solid over the last year. That being said, in a fragmented A/E and environmental consulting market, today’s prices are more dependent than ever on a breadth of target specific attributes. Those include market sector/client base, firm size, growth rates, synergistic qualities, geographic locations, revenue diversity, depth of management team, and, of course, profitability. As always, managing expectations and minimizing surprises is half the battle going into the process.

At Rusk O’Brien Gido + Partners, we possess strong relationships and years of experience navigating A/E and environmental buyers and sellers through the M&A process and towards winning combinations. Whether you are seeking to grow through acquisitions or by evaluating your firm’s strategic and ownership alternatives, please contact us as to how we can help your organization.

On a final note, Season’s Greetings and a Happy, Healthy and Prosperous New Year from all of us here at ROG+ Partners!