Michael S. O'Brien is a principal in the Washington, DC office of Rusk O'Brien Gido + Partners. He specializes in corporate financial advisory services including business valuation, fairness and solvency opinions, mergers and acquisitions, internal ownership transition consulting, ESOPs, and strategic planning. Michael has consulted hundreds of architecture, engineering, environmental and construction companies across the U.S. and abroad.

Stock Redemption Liabilities: Are You in Position to Avoid the Cash Flow Crunch?

Stock Redemption Liabilities: Are You in Position to Avoid the Cash Flow Crunch?

May 20, 2013

As a leading provider of business valuation services to companies operating in the architecture, engineering, and environmental consulting industries, we have the unique advantage of witnessing many of the leading indicators affecting valuations. For the past 15 years we have collectively conducted approximately 750 business valuations in this niche market. In addition to the many valuations that we conduct annually for ERISA requirements or in accordance with shareholders’ agreements, we are increasingly seeing more firms take a holistic approach to their strategic planning, an approach that often includes a more probing look at managing shareholder redemption obligations.

Since 2004, we’ve sounded the warning bells about what the impact of an ever-growing number of retiring employees would have on a company’s ability to redeem shares. The “Great Recession” has further increased this risk, because as many firms experienced severe depressions in value, they’ve been left with little other choice than to delay leadership and ownership transition planning.

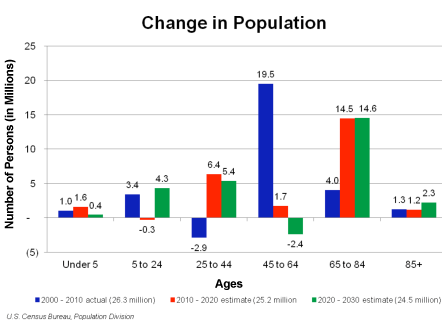

Over the next two decades, the rate of change in population demographics will have a significant effect on value, liquidity, and leadership succession. The following graph shows that the population of those between 65 and 84 years of age will increase by nearly 30 million people. During the same period, the population of those between 25 and 64 years of age will only increase by 11.1 million individuals, or nearly one-third of those individuals reaching retirement age.

Since 2004, we’ve sounded the warning bells about what the impact of an ever-growing number of retiring employees would have on a company’s ability to redeem shares. The “Great Recession” has further increased this risk, because as many firms experienced severe depressions in value, they’ve been left with little other choice than to delay leadership and ownership transition planning.

Over the next two decades, the rate of change in population demographics will have a significant effect on value, liquidity, and leadership succession. The following graph shows that the population of those between 65 and 84 years of age will increase by nearly 30 million people. During the same period, the population of those between 25 and 64 years of age will only increase by 11.1 million individuals, or nearly one-third of those individuals reaching retirement age.

So why is ownership planning more important now than it’s ever been? We’ve recently begun to see improvements in the overall economy, including long-term growth rates that are gradually beginning to edge upwards. As companies begin to grow again, their need to invest in working capital will also grow. However, if a company’s future cash flows are needed to fund stock redemption obligations, its ability to invest in growth will be impaired. Or even worse, it might not have sufficient cash flow to provide the required incentive compensation to its employees to mitigate employee turnover.

To ensure that your firm will be positioned to thrive when growth begins to commence in earnest, incorporating a shareholder redemption liability study in your annual strategic planning should be of chief importance. A mere awareness of imminent redemptions is a sign of inadequate planning – you also must know how those redemptions will influence your company’s ability to fund future growth while continuing to reward employees.

To learn more about how you can minimize your redemption risk and how your peers are addressing this issue, give me a call or plan to join us at our Growth & Ownership Strategies Conference November 6-8, in Naples, Florida.

To ensure that your firm will be positioned to thrive when growth begins to commence in earnest, incorporating a shareholder redemption liability study in your annual strategic planning should be of chief importance. A mere awareness of imminent redemptions is a sign of inadequate planning – you also must know how those redemptions will influence your company’s ability to fund future growth while continuing to reward employees.

To learn more about how you can minimize your redemption risk and how your peers are addressing this issue, give me a call or plan to join us at our Growth & Ownership Strategies Conference November 6-8, in Naples, Florida.

Latest Perspective

Perfecting the A/E Exit Strategy – Five Key Factors

An enormous A/E generation that kicked off their careers in the 1980s and subsequently started firms or became owners in the 1990s ...

© 2024

Rusk O'Brien Gido + Partners, LLC

Financial Experts for Architects, Engineers, and Environmental Consulting Firms