Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

A Shifting Outlook for the A/E Industry

April 9, 2025

For the A/E industry, 2024 ended with widespread optimism, strong contract backlogs, and record financial performance for many firms. This is based on the reported performance of publicly traded A/E firms and supported by anecdotal observations of private firms.

As earnings reports were released in February from firms such as TetraTech, AECOM, Jacobs Solutions, Stantec and NV5 Global, the news was almost all positive. Below are a handful of highlights.

AECOM (February 3, 2025)

- Net revenue for the first quarter of 2025, up 5% year-over-year

- Adjusted earnings per share up 25%

- First quarter profit margin at record level

- Backlog and pipeline at record levels

Stantec (January 28, 2025)

- Net revenue for fiscal year up 15.8%

- Adjusted EBITDA up 16.7% (margin up 30 basis points)

- Earnings per share up 20.4%

- Fourth quarter revenue growth accelerating at 19% year-over-year

- Backlog at a high of $7.8 billion

Jacobs Solutions (February 4, 2025)

- First quarter net revenue up 5.1% year-over-year

- Projected adjusted EBITDA of 13.8 – 14.0%

- Raised EPS guidance from $5.80 to $6.20 for fiscal year 2025

TetraTech

- First quarter net revenue up 18% to 1.2 billion

- Operating income up by 24%

- Earnings per share up 25%

- Contract backlog up 15% to $5.44 billion

NV5 Global (February 20, 2025)

- Fiscal year 2024 gross revenue up 10%

- Gross profit up 13%

- Projected fiscal year 2025 gross revenue of $1.03+ billion (9.5% growth)

But much has changed since the calendar year-end. Tariffs, both threatened and enacted, have pushed up already inflated construction costs and created fears of a global trade war. Interest rates have remained high relative to recent historical levels. And funding cuts and layoffs at federal agencies have had a direct impact on current and future capital projects.

For many smaller A/E firms, these actions have yet to cause any meaningful disruptions in their operations, but larger firms focused on federally funded programs are already feeling the pain. As an example, the administration has targeted the U.S. Agency for International Development (USAID), which has been a major client of firms such as TetraTech, particularly in its work to support Ukraine's energy security and independence.

Tariffs Roil the Markets

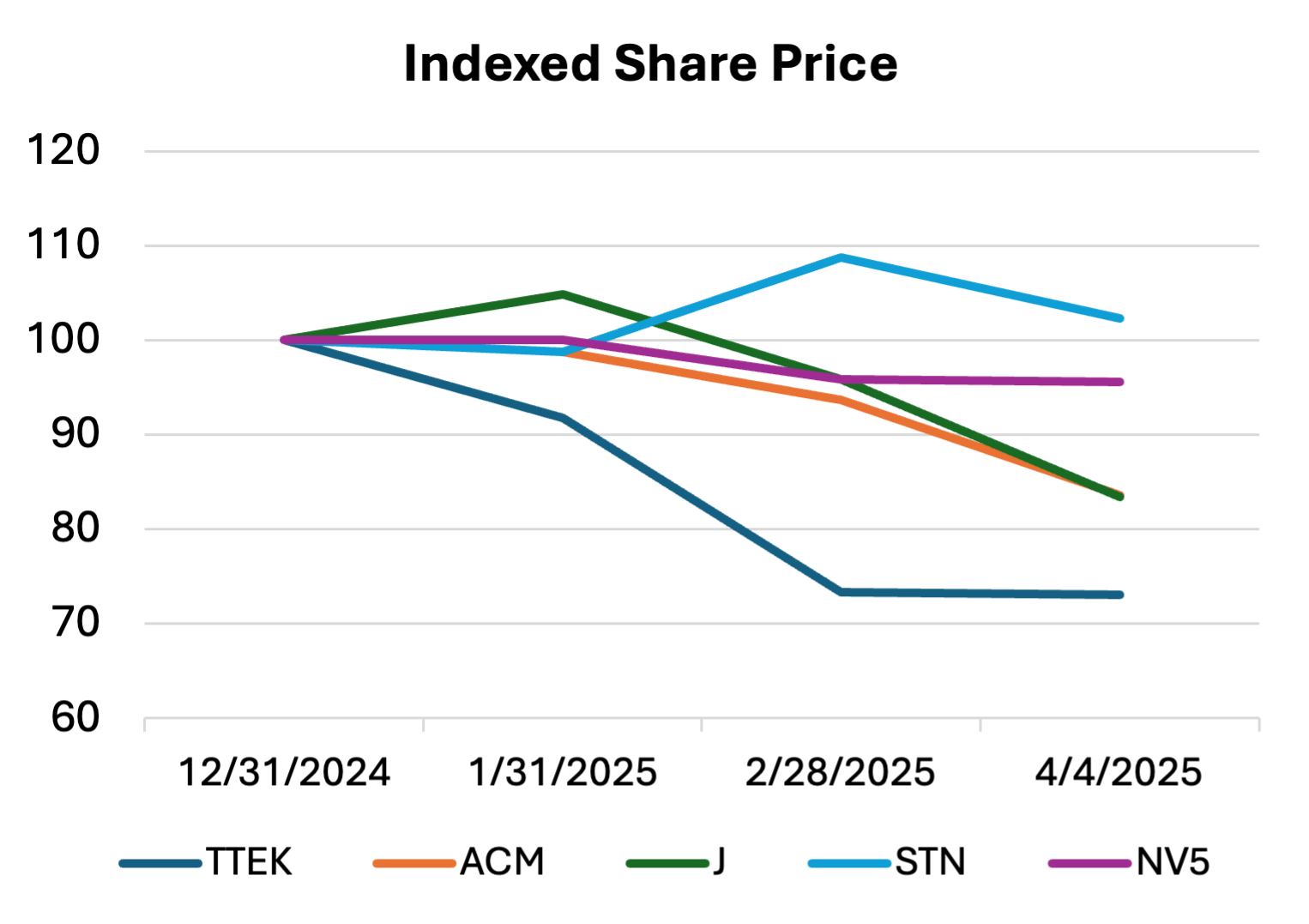

As illustrated in the following chart, since the calendar year-end, the share prices of major publicly traded A/E firms were down from 4.5% (NV5 Global) to 27.0% (TetraTech), with Stantec being the only firm bucking that trend.

Certain industries are more likely to be impacted by tariffs, including consumer electronics, communications, automotive and other manufacturing, and battery technology, all of which are particularly dependent on imports from China. So companies serving clients in these sectors could see capital projects postponed or cancelled due to pressure on margins, and/or rising construction costs. The long-term impact will depend on whether the White House’s is committed to these tariffs, or if it intends to use them as a short-term bargaining tool.

The underlying U.S. economy had seemed strong until this point. On the same date that the announced tariffs took effect, the Bureau of Labor Statistics reported that overall non-farm payroll employment rose by 228,000 in March, and the national unemployment rate remained low at 4.2%. Within the Architectural, Engineering and Related Services sector, employment increased by approximately 3,900 jobs in March, and was up by 53,700 jobs year-over-year (seasonally adjusted).

An Opportunity for Talent Acquisition

A silver lining to the recent cuts to federal agencies is the opportunity to pick up seasoned professionals from the public sector. We are already hearing from clients that have recently hired experienced professional engineers and scientists who have been let go from federal agencies, or who have voluntarily resigned. These layoffs have also left agencies with fewer internal resources, requiring them to outsource more work to private sector consulting engineers, planners and scientists. If this marks the beginning of a trend toward more privatization of these services, the A/E industry could benefit in the longer term.

Overall, U.S. markets for A/E services have proven remarkably resilient in recent years, and there remains an underlying need for public infrastructure, housing, healthcare facilities, and other building types, even though the interest rate environment and construction costs may delay projects in the near-term. Furthermore, while the federal administration’s actions have created considerable uncertainty, the majority of infrastructure spending continues to be controlled by state and local agencies. That said, it’s difficult to reconcile the last quarter’s rosy earnings reports with the recent market turmoil. With respect to the impact on the A/E sector, much will depend on whether the administration is playing an international game of “chicken” or if it’s committed to a vastly different trade policy and willing to suffer the near-term economic consequences.

Latest Perspective

A Shifting Outlook for the A/E Industry

For the A/E industry, 2024 ended with widespread optimism, strong contract backlogs, and record financial performance for many firms ...

Rusk O'Brien Gido + Partners, LLC