Michael S. O'Brien is a principal in the Washington, DC office of Rusk O'Brien Gido + Partners. He specializes in corporate financial advisory services including business valuation, fairness and solvency opinions, mergers and acquisitions, internal ownership transition consulting, ESOPs, and strategic planning. Michael has consulted hundreds of architecture, engineering, environmental and construction companies across the U.S. and abroad.

Could A/E Firms Avoid a Recession?

June 21, 2023

Last month we shared with you that despite the looming economic conditions, the A/E sector may avoid a recession with continued growth supported by strengthening backlogs. Here's some more empirical evidence that supports this claim and long-term expectations.

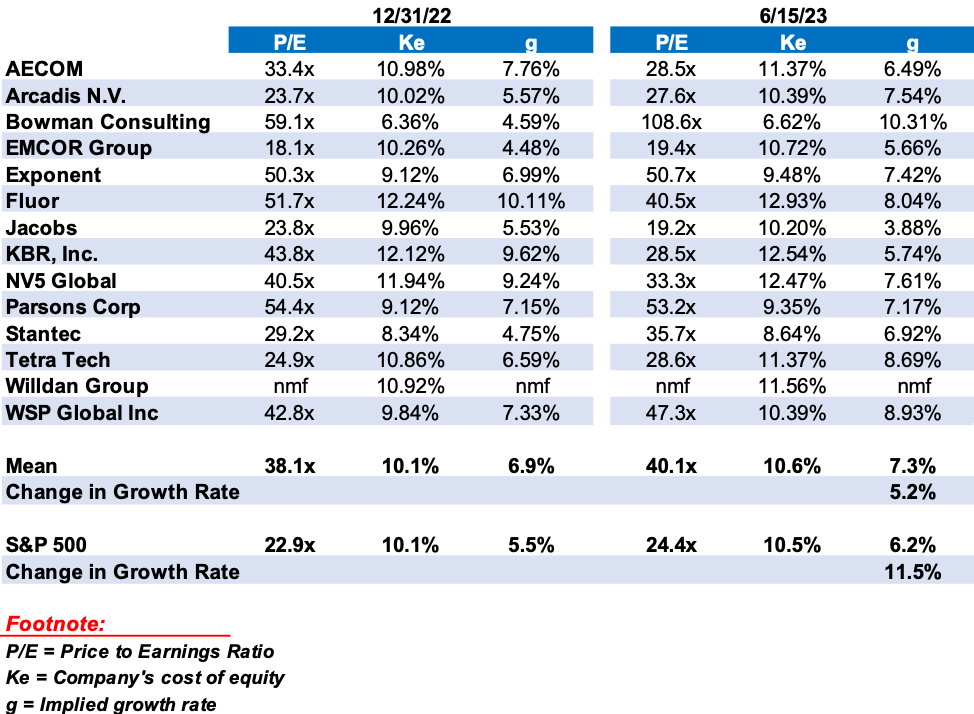

Implied growth rates refer to the long-term growth expectations (typically five years) embedded in the market's valuation of a company. These rates are derived by analyzing the company's cost of capital and P/E multiples.

The cost of capital is the required rate of return expected by investors – most of which are institutional – based on their understanding of the underlying risk of these companies' current EPS (earnings per share) and their respective projected growth rates. A higher cost of capital (or greater required rate of return) reflects the higher risk level investors place on a company's ability to achieve the projected near-term and long-term growth rates. The P/E multiple is the price at which the stock trades relative to the companies' earnings per share.

It would be instructive to consider the companies presented in our May Perspective and compare their implied growth expectations to the implied growth for the S&P 500, which is the bellwether for the overall economy.

According to the chart above, the mean growth rate for the A/E firms was 6.9% as of December 31, 2022, and marginally increased to 7.3% as of June 16, 2023, or a 4.9% increase. Meanwhile, the S&P 500 growth rates came in lower than the A/E sector at 5.5% as of December 31, 2022, and increased significantly to 6.2% as of June 16, 2023, or an 11.5% increase. The modest growth rate change indicates lower volatility relative to the S&P 500. The S&P 500 index is market capitalization-weighted, which means that the largest market cap companies influence the direction of the index. The top ten companies represent 25.5% of the index. A cautionary note; when trying to infer an entire industry's outlook based on public firm stock performance, it's very important to look at a basket of companies instead of any one firm in particular. There could be unique facts and recent circumstances driving investors' assessments of any particular firm.

Implied growth rates:

- reflects what the market anticipates regarding the company's future growth prospects.

- provide insights into the market's perception of a company's growth potential. A higher implied growth rate than historical growth indicates that a company is expected to outperform its past performance

- reflect the competitive landscape and market conditions. Strength in increasing backlog with a tight labor market indicates a competitive advantage for firms with strong client relations

Since the beginning of the year, the Federal Reserve increased the Fed Funds rate by 75 basis points. Yet, on average, the cost of equity capital only increased by 50 basis points. This lower change indicates that investors had already "baked-in" these rate increases at the beginning of the year. Furthermore, this analysis indicates that investors believe rising interest rates are not impacting projects moving forward.

So, what is driving this growth expectation? Many factors drive long-term growth expectations. However, at ROG, our in-depth insight to firms across many sectors of the A/E industry gives us a birds-eye view of what's driving growth. Here are a few that come to mind.

Infrastructure Investments: Federal, state, and local governments have recognized the need for significant investments in infrastructure, including transportation, utilities, and public facilities. These investments can create a strong demand for architecture and engineering services, particularly in transportation systems, sustainable infrastructure, and urban development. This was supported by the Infrastructure Investment and Jobs Act (IIJA).

Sustainable Design and Construction: The emphasis on sustainability and environmental considerations continues to grow in the architecture and engineering industry. Firms offering expertise in green building design, renewable energy systems, and sustainable practices will likely see increased demand as clients prioritize environmental stewardship and energy efficiency.

Urbanization and Population Growth: Rapid urbanization and population growth in many regions drive the need for expanded infrastructure, residential developments, and commercial spaces. Architecture and engineering firms involved in urban planning, mixed-use projects, and innovative city initiatives can benefit from these trends.

Resilience and Adaptation: Increasing concerns about climate change, natural disasters, and resilience have prompted the need for architecture and engineering solutions that can withstand and adapt to such challenges. Firms specializing in resilient design, disaster recovery planning, and adaptive infrastructure will likely find opportunities in this evolving landscape.

Shifts in Work Practices: The COVID-19 pandemic has accelerated the adoption of remote work and digital collaboration tools. Architecture and engineering firms may need to adapt their work practices to accommodate flexible and hybrid work arrangements while ensuring effective collaboration, client interactions, and project delivery. This, in turn, has impacted how companies utilize office space.

The long-term prospects for the A/E industry look bright. While a looming economic recession could negatively impact this sector, it would be minor compared to other sectors. The IIJA, sustainable design, urbanization and population growth, climate change, and workplace practices create long-term demand for architecture and engineering services.