Ian has spent the past twenty years working with hundreds of architecture, engineering and environmental consulting firms large and small throughout the U.S. and abroad with a focus on ownership planning, business valuation, ESOP advisory services, mergers & acquisitions, and strategic planning. Ian is a professionally trained and accredited business appraiser and holds the Accredited Senior Appraiser (ASA) designation with the American Society of Appraisers and is a certified merger & acquisition advisor (CM&AA) with the Alliance of Merger & Acquisition Advisors.

ESOPs — is there a plan that will work for your firm?

June 16, 2014

Employee Stock Ownership Plans, or ESOPs, are increasing in popularity as a vehicle for ownership transition, but in spite of this, they are frequently misunderstood. In this article, we examine the recent trends in ESOP ownership and address some of the misconceptions.

Recent ESOP Trends

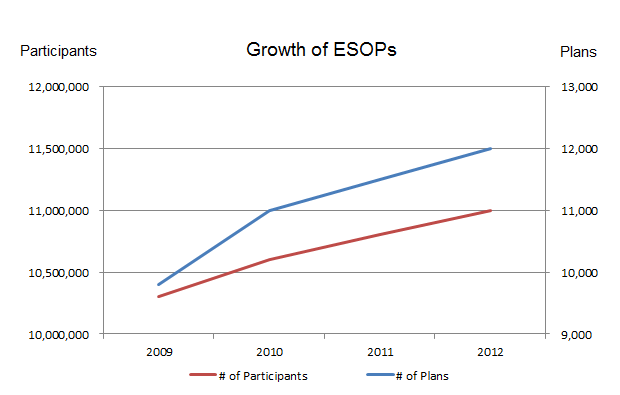

According to the National Center for Employee Ownership—a private non-profit research organization, since the recession, both the number of plans, and the number of employee-participants have increased steadily.

Recent ESOP Trends

According to the National Center for Employee Ownership—a private non-profit research organization, since the recession, both the number of plans, and the number of employee-participants have increased steadily.

source: National Center for Employee Ownership (www.nceo.org)

This trend is even more pronounced within the architecture, engineering and environmental consulting industry. Firms in these industries already make up a disproportionate percentage of ESOP-sponsoring companies. Among the 100 largest employee-owned firms in the U.S. as reported by NCEO (defined as a company that is at least 50% owned by an ESOP or other type of qualified plan) approximately 20% are in the design and construction industries.

Our anecdotal experience working with industry firms on ownership transition planning efforts also suggests that more and more firms are implementing or considering implementing ESOPs. Furthermore, in our annual A/E Business Valuation and M&A Transactions Study, 20% of participating firms reported that they sponsored an ESOP.

Why the trend toward ESOPs?

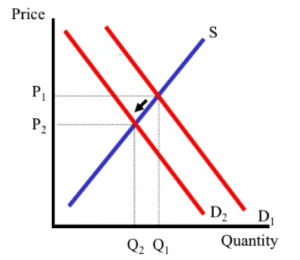

The simplest answer to the question above is “supply and demand.” In the U.S. we are in the midst of a demographic shift, with the “baby-boomer” generation moving into retirement, and the younger generations “X and Y” moving into larger leadership roles. With the baby-boomers representing sellers (or the supply side of the equation), and generations X and Y representing buyers (or the demand side of the equation), we have the classic Economics 101 supply & demand curve shift.

If the demand (D) for stock is less than the supply (S), all other things being equal, the price (P) and quantity (Q) will fall, as the supply and demand chart below illustrates. In an ownership transition scenario this will result in lower value for the sellers and a longer or delayed transition.

This trend is even more pronounced within the architecture, engineering and environmental consulting industry. Firms in these industries already make up a disproportionate percentage of ESOP-sponsoring companies. Among the 100 largest employee-owned firms in the U.S. as reported by NCEO (defined as a company that is at least 50% owned by an ESOP or other type of qualified plan) approximately 20% are in the design and construction industries.

Our anecdotal experience working with industry firms on ownership transition planning efforts also suggests that more and more firms are implementing or considering implementing ESOPs. Furthermore, in our annual A/E Business Valuation and M&A Transactions Study, 20% of participating firms reported that they sponsored an ESOP.

Why the trend toward ESOPs?

The simplest answer to the question above is “supply and demand.” In the U.S. we are in the midst of a demographic shift, with the “baby-boomer” generation moving into retirement, and the younger generations “X and Y” moving into larger leadership roles. With the baby-boomers representing sellers (or the supply side of the equation), and generations X and Y representing buyers (or the demand side of the equation), we have the classic Economics 101 supply & demand curve shift.

If the demand (D) for stock is less than the supply (S), all other things being equal, the price (P) and quantity (Q) will fall, as the supply and demand chart below illustrates. In an ownership transition scenario this will result in lower value for the sellers and a longer or delayed transition.

In many cases, an ESOP can help “pick up the slack” by serving as an additional buyer, and helping the sponsoring company maintain supply and demand equilibrium.

“But we don’t want to be an ESOP company”

This is a common refrain, and often originates from a lack of understanding of the many shapes and sizes an ESOP can take. It’s a mistake to characterize a firm that sponsors an ESOP as simply “an ESOP Company.” An ESOP is simply a qualified plan (like a 401(k) plan) that is designed to invest primarily in its sponsoring company’s stock. The ESOP is considered to be a single owner, and the employees of the firm are its beneficiaries. Just like any individual owner, the ESOP’s ownership could range from a very small minority interest in the Company, all the way up to a 100% interest. An ESOP may also be leveraged, having borrowed money from a third party to fund its acquisition of stock, or unleveraged / pre-funded, using annual profit contributions from the company to acquire shares over time.

Unfortunately, many peoples’ perceptions of ESOPs are informed by a single personal experience, or that of a friend or colleague. If that experience involved a leveraged ESOP that owned a majority of the sponsoring company’s stock, their assumption might be that all ESOPs take this form, which of course is incorrect.

In fact, the most common form of ESOP we encounter in the A/E industry is one that holds a minority interest (often between 20% and 40%) and is not leveraged. This form of ESOP allows the company to be majority owned by its senior management, while providing a stock-based benefit to its entire workforce, and taking advantage of the tax benefits the ESOP affords.

Tax benefits can be substantial

The primary tax benefits that an ESOP provides relate to the tax-deductibility of the company’s contributions to the plan. Because contributions to the plan are a deductible compensation expense, the company can effectively use pre-tax dollars to fund the redemption of shares from a retiring owner. Thus a $1 million block of stock, if purchased by the ESOP using contributions from the company, would result in a tax savings of approximately $350 thousand (assuming a 35% corporate tax rate).

ESOPs bring additional tax benefits to S-corporations. Because S-corporations are pass-through tax entities (the income tax obligation associated with corporate profits flows through on a pro-rata basis to the owners), and because the ESOP is not a taxable entity, the ESOP’s share of the sponsoring company’s taxable income is effectively sheltered from taxation.

Finally, in certain circumstances, an individual who sells his or her shares to an ESOP may be able to defer the capital gain associated with the sale. This benefit applies only to the sale of stock in a C-corporation, and only if the ESOP holds a 30% interest after the transaction. The seller must also roll over the proceeds into investments that meet the IRS definition of “qualified replacement property” in order to defer the gain.

Other Considerations

There are other considerations as well. Company culture, management structure, and corporate governance structure are all factors to consider. Generally speaking, firms that already have widely distributed ownership, practice open book management, and promote employee participation in management are better suited for ESOP ownership than those that do not.

From a financial point of view, a feasibility analysis prepared by a qualified financial advisor can illustrate how an ESOP might work in your firm, taking into consideration factors such as: 1.) The company’s stock value; 2.) Future stock redemption liabilities; 3.) Projected direct stock investment by individual owners; 4.) The projected growth and earnings of the company; 5.) The ages and compensation of your workforce.

If you’re interested in learning more about how an ESOP might fit with your firm’s ownership strategy, feel free to contact us. And please plan on joining us at the annual A/E Growth & Ownership Strategies Conference taking place from November 12th – 14th in Naples, Florida. A pre-conference workshop will cover ESOPs in the context of other ownership transition strategies, and a special break-out session will cover the legal and financial mechanics of establishing an ESOP.

For more information and to register, please visit the event website at:

www.rog-partners.com/conference/home.html

“But we don’t want to be an ESOP company”

This is a common refrain, and often originates from a lack of understanding of the many shapes and sizes an ESOP can take. It’s a mistake to characterize a firm that sponsors an ESOP as simply “an ESOP Company.” An ESOP is simply a qualified plan (like a 401(k) plan) that is designed to invest primarily in its sponsoring company’s stock. The ESOP is considered to be a single owner, and the employees of the firm are its beneficiaries. Just like any individual owner, the ESOP’s ownership could range from a very small minority interest in the Company, all the way up to a 100% interest. An ESOP may also be leveraged, having borrowed money from a third party to fund its acquisition of stock, or unleveraged / pre-funded, using annual profit contributions from the company to acquire shares over time.

Unfortunately, many peoples’ perceptions of ESOPs are informed by a single personal experience, or that of a friend or colleague. If that experience involved a leveraged ESOP that owned a majority of the sponsoring company’s stock, their assumption might be that all ESOPs take this form, which of course is incorrect.

In fact, the most common form of ESOP we encounter in the A/E industry is one that holds a minority interest (often between 20% and 40%) and is not leveraged. This form of ESOP allows the company to be majority owned by its senior management, while providing a stock-based benefit to its entire workforce, and taking advantage of the tax benefits the ESOP affords.

Tax benefits can be substantial

The primary tax benefits that an ESOP provides relate to the tax-deductibility of the company’s contributions to the plan. Because contributions to the plan are a deductible compensation expense, the company can effectively use pre-tax dollars to fund the redemption of shares from a retiring owner. Thus a $1 million block of stock, if purchased by the ESOP using contributions from the company, would result in a tax savings of approximately $350 thousand (assuming a 35% corporate tax rate).

ESOPs bring additional tax benefits to S-corporations. Because S-corporations are pass-through tax entities (the income tax obligation associated with corporate profits flows through on a pro-rata basis to the owners), and because the ESOP is not a taxable entity, the ESOP’s share of the sponsoring company’s taxable income is effectively sheltered from taxation.

Finally, in certain circumstances, an individual who sells his or her shares to an ESOP may be able to defer the capital gain associated with the sale. This benefit applies only to the sale of stock in a C-corporation, and only if the ESOP holds a 30% interest after the transaction. The seller must also roll over the proceeds into investments that meet the IRS definition of “qualified replacement property” in order to defer the gain.

Other Considerations

There are other considerations as well. Company culture, management structure, and corporate governance structure are all factors to consider. Generally speaking, firms that already have widely distributed ownership, practice open book management, and promote employee participation in management are better suited for ESOP ownership than those that do not.

From a financial point of view, a feasibility analysis prepared by a qualified financial advisor can illustrate how an ESOP might work in your firm, taking into consideration factors such as: 1.) The company’s stock value; 2.) Future stock redemption liabilities; 3.) Projected direct stock investment by individual owners; 4.) The projected growth and earnings of the company; 5.) The ages and compensation of your workforce.

If you’re interested in learning more about how an ESOP might fit with your firm’s ownership strategy, feel free to contact us. And please plan on joining us at the annual A/E Growth & Ownership Strategies Conference taking place from November 12th – 14th in Naples, Florida. A pre-conference workshop will cover ESOPs in the context of other ownership transition strategies, and a special break-out session will cover the legal and financial mechanics of establishing an ESOP.

For more information and to register, please visit the event website at:

www.rog-partners.com/conference/home.html