Michael S. O'Brien is a principal in the Washington, DC office of Rusk O'Brien Gido + Partners. He specializes in corporate financial advisory services including business valuation, fairness and solvency opinions, mergers and acquisitions, internal ownership transition consulting, ESOPs, and strategic planning. Michael has consulted hundreds of architecture, engineering, environmental and construction companies across the U.S. and abroad.

The Optimal Allocation of Your Firm’s Return on Investment

October 8, 2015

If we were asked to identify the most recent, sweeping trend of ownership planning, it would be the restart of ownership plans that were put on hold due to the last recession. The recession caused many firms to suspend their transition plans because their stock values had fallen so dramatically. The common owners’ lament was “the amount of money I needed or expected for retirement was no longer there.”

This is one of the greatest conundrums of being a major employee-shareholder in a privately held firm. The largest risk to your retirement planning is likely to be a lack of portfolio diversification. Your compensation, benefits, and a significant portion of your retirement assets are likely tied-up in one asset – your firm. Over the past five years in particular, I have learned from helping A/E firms with their ownership transition plans just how much of many companies’ total return on investment is driven by capital appreciation, rather than income. It may be time to rethink this strategy.

As a rule, investors require a return that adequately reflects the risk of that investment. Understanding where you can generate your returns is essential to understanding how you can mitigate your retirement risk. Shareholder returns come in one of two forms: capital (stock) appreciation and dividends (income). The composite of these components is known as “total return on investment,” and is used by investors to decide how and where to allocate investment capital. The required rate of return is a function of the risk of that investment and the relationship between the two is generally thought of as having a high, positive correlation. The greater the risk of an investment, the greater the return required.

Long-term returns are tied directly to the capital appreciation of the underlying asset (stock in your company). For example, if you purchased shares at a price of $10 per share, then ten years later, sold them for $40 per share, your compounded return on investment would be approximately 15%. Short-term returns are often tied to the annual income that the underlying asset produces and pays out to investors. This income is generally identified as:

If you were given three alternatives for an investment and could only pick one, which alternative would you choose?

Alternative 1: Annual stock price appreciation is projected to be 20% per annum, profit distributed equals 2% of the previous year’s stock price (i.e. dividend yield), and total cash to be received over the life of the investment is projected to be $57.11 per share (including the sale of your share in the future), thus yielding a total return of 22%.

This is one of the greatest conundrums of being a major employee-shareholder in a privately held firm. The largest risk to your retirement planning is likely to be a lack of portfolio diversification. Your compensation, benefits, and a significant portion of your retirement assets are likely tied-up in one asset – your firm. Over the past five years in particular, I have learned from helping A/E firms with their ownership transition plans just how much of many companies’ total return on investment is driven by capital appreciation, rather than income. It may be time to rethink this strategy.

As a rule, investors require a return that adequately reflects the risk of that investment. Understanding where you can generate your returns is essential to understanding how you can mitigate your retirement risk. Shareholder returns come in one of two forms: capital (stock) appreciation and dividends (income). The composite of these components is known as “total return on investment,” and is used by investors to decide how and where to allocate investment capital. The required rate of return is a function of the risk of that investment and the relationship between the two is generally thought of as having a high, positive correlation. The greater the risk of an investment, the greater the return required.

Long-term returns are tied directly to the capital appreciation of the underlying asset (stock in your company). For example, if you purchased shares at a price of $10 per share, then ten years later, sold them for $40 per share, your compounded return on investment would be approximately 15%. Short-term returns are often tied to the annual income that the underlying asset produces and pays out to investors. This income is generally identified as:

- Distributed profits allocated based on ownership interest – common with S-corporations and limited liability companies

- Dividends distributed – common with C-corporations

- “Owners’ Bonus” – compensation – most common with C-corporations

If you were given three alternatives for an investment and could only pick one, which alternative would you choose?

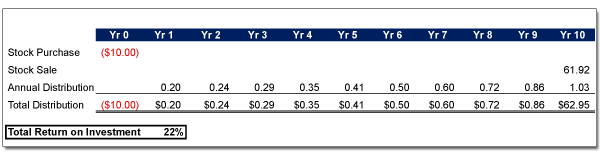

Alternative 1: Annual stock price appreciation is projected to be 20% per annum, profit distributed equals 2% of the previous year’s stock price (i.e. dividend yield), and total cash to be received over the life of the investment is projected to be $57.11 per share (including the sale of your share in the future), thus yielding a total return of 22%.

Alternative 2:

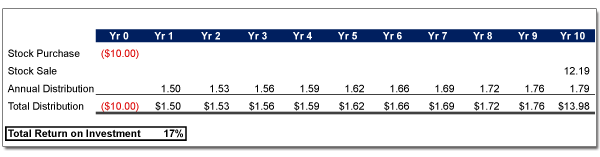

Annual stock price appreciation is projected to be 2% per annum, the dividend yield is 15%, and total cash to be received over the life of the investment is projected to be $18.61 per share, thus yielding a total return of 17%.

Alternative 3:

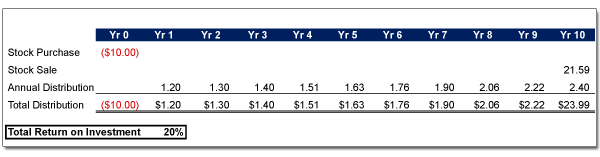

Annual stock price appreciation is projected to be 8% per annum, the dividend yield is 12%, and total cash to be received over the life of the investment is projected to be $28.67 per share, thus yielding a total return of 20%.

All three investments look attractive. Alternative 1 looks very attractive because it has the highest return and since the capital gains tax rate is much lower than income tax rates, the after-tax value is even more favorable. Ninety-one percent of the return is tied to stock appreciation. Alternative 2 is appealing because the majority of the return is tied to income, but it provides for the lowest return on investment. You receive your return annually, which provides greater liquidity for your shares because investors can rely on annual cash flows to help fund the purchase of the shares. Eighty-eight percent of the total return is derived from income rather than stock appreciation. Finally, Alternative 3 might be appealing because while there is meaningful stock appreciation, there is also solid annual income being generated. The return is lower than Alternative 1, but only 40% of the total return is tied to stock appreciation. The last alternative is meaningful because in the event that your investment is worthless by the time you retire, not all is lost. All things being equal, you will have generated a return of 12%. This may not meet your return requirement, but it does limit your downside risk.

The illiquidity of the underlying shares poses one of the greatest investment risks of ownership in your closely-held company. The typical discount applied to closely held companies for lack of marketability ranges from 13% to 40%. The larger the portion of the return that is tied to capital appreciation, the greater the discount. Because there is no public market for your shares, the inherent risk of such an illiquid investment is much higher than the risk of an investment that can be disposed of at any time. Generally, closely-held companies have to create a market for their shares by ensuring annual income that is tied directly or indirectly to ownership in the company.

Where your returns come from will vary from time to time. As your firm seeks growth opportunities, current returns are likely to decline in order to fund growth. However, being mindful of where your returns are derived will force you to seek growth strategies that mitigate profit dilution.

In analyzing year-end S&P data, we found that over the past five years, dividends comprised an average of 14% of the total return of the index. For the past twenty years it was not much higher, averaging 18%. Thinking about this in a different context, we can infer that investors do NOT look to dividends so much as they do to capital appreciation for meeting their return requirements. This is primarily due to the inherent liquidity of the shares of public traded companies because when the future outlook for a given company turns negative the investor can dispose their shares immediately. However, in a closely held A/E firm, the opposite is true.

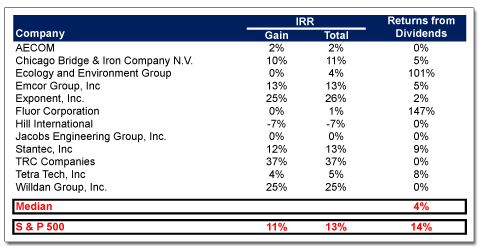

The table below summarizes some of the publicly traded A/E firms that we analyzed. Of the twelve companies, five did not pay any dividends. Ecology and Environment Group provides some very interesting results, because it is the only firm that is thinly traded. If anything, this firm could closely reflect similar liquidity risks to closely-held companies. Over the last five years all of its returns have been from its quarterly dividends.

The illiquidity of the underlying shares poses one of the greatest investment risks of ownership in your closely-held company. The typical discount applied to closely held companies for lack of marketability ranges from 13% to 40%. The larger the portion of the return that is tied to capital appreciation, the greater the discount. Because there is no public market for your shares, the inherent risk of such an illiquid investment is much higher than the risk of an investment that can be disposed of at any time. Generally, closely-held companies have to create a market for their shares by ensuring annual income that is tied directly or indirectly to ownership in the company.

Where your returns come from will vary from time to time. As your firm seeks growth opportunities, current returns are likely to decline in order to fund growth. However, being mindful of where your returns are derived will force you to seek growth strategies that mitigate profit dilution.

In analyzing year-end S&P data, we found that over the past five years, dividends comprised an average of 14% of the total return of the index. For the past twenty years it was not much higher, averaging 18%. Thinking about this in a different context, we can infer that investors do NOT look to dividends so much as they do to capital appreciation for meeting their return requirements. This is primarily due to the inherent liquidity of the shares of public traded companies because when the future outlook for a given company turns negative the investor can dispose their shares immediately. However, in a closely held A/E firm, the opposite is true.

The table below summarizes some of the publicly traded A/E firms that we analyzed. Of the twelve companies, five did not pay any dividends. Ecology and Environment Group provides some very interesting results, because it is the only firm that is thinly traded. If anything, this firm could closely reflect similar liquidity risks to closely-held companies. Over the last five years all of its returns have been from its quarterly dividends.

Unlike the returns of a publicly-traded stock, A/E shareholder returns are generally comprised of a higher ratio of dividends-to-capital-appreciation than what is seen in the capital markets. Why? Primarily because of the restrictive nature of share transactions in A/E firms. In most firms, shareholders agreements allow for redemption of stock only upon retirement, termination of employment and events such as the death or disability of a shareholder. Further, even once you’ve successfully sold your shares, you may still be at risk of not receiving full payment if the company’s performance deteriorates. After the recession, we witnessed numerous companies having to go back to former shareholders to renegotiate recent stock repurchase deals due to the company’s inability to make the associated note payments.

A couple of final thoughts: The primary assets of an A/E firm are its employees. Investment in these “assets” is critical for your company to remain a viable going-concern. Therefore, shouldn’t there be regular distributions or “compensation” paid to those who are driving the success of the firm? If you also consider that smaller A/E firms are more often subject to key person(s) risks than larger firms, you can draw the reasonable conclusion that the goodwill value of such firms is more personal in nature and more likely to be impaired upon the retirement or termination of a key person. Given the risk of impairment of the goodwill value in such a firm, shouldn’t the total return on investment be less dependent on stock value appreciation? These are yet more arguments for structuring a larger portion of a firm’s return on investment in the form of income to shareholders.

A couple of final thoughts: The primary assets of an A/E firm are its employees. Investment in these “assets” is critical for your company to remain a viable going-concern. Therefore, shouldn’t there be regular distributions or “compensation” paid to those who are driving the success of the firm? If you also consider that smaller A/E firms are more often subject to key person(s) risks than larger firms, you can draw the reasonable conclusion that the goodwill value of such firms is more personal in nature and more likely to be impaired upon the retirement or termination of a key person. Given the risk of impairment of the goodwill value in such a firm, shouldn’t the total return on investment be less dependent on stock value appreciation? These are yet more arguments for structuring a larger portion of a firm’s return on investment in the form of income to shareholders.